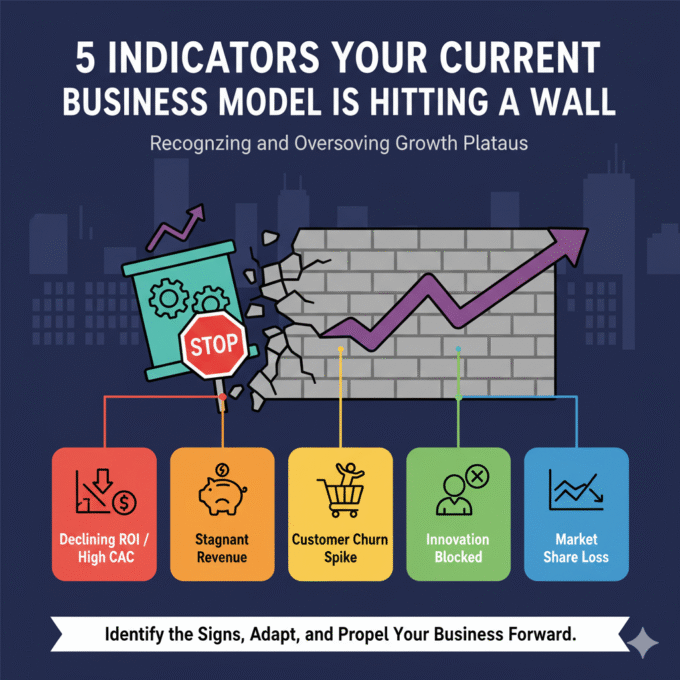

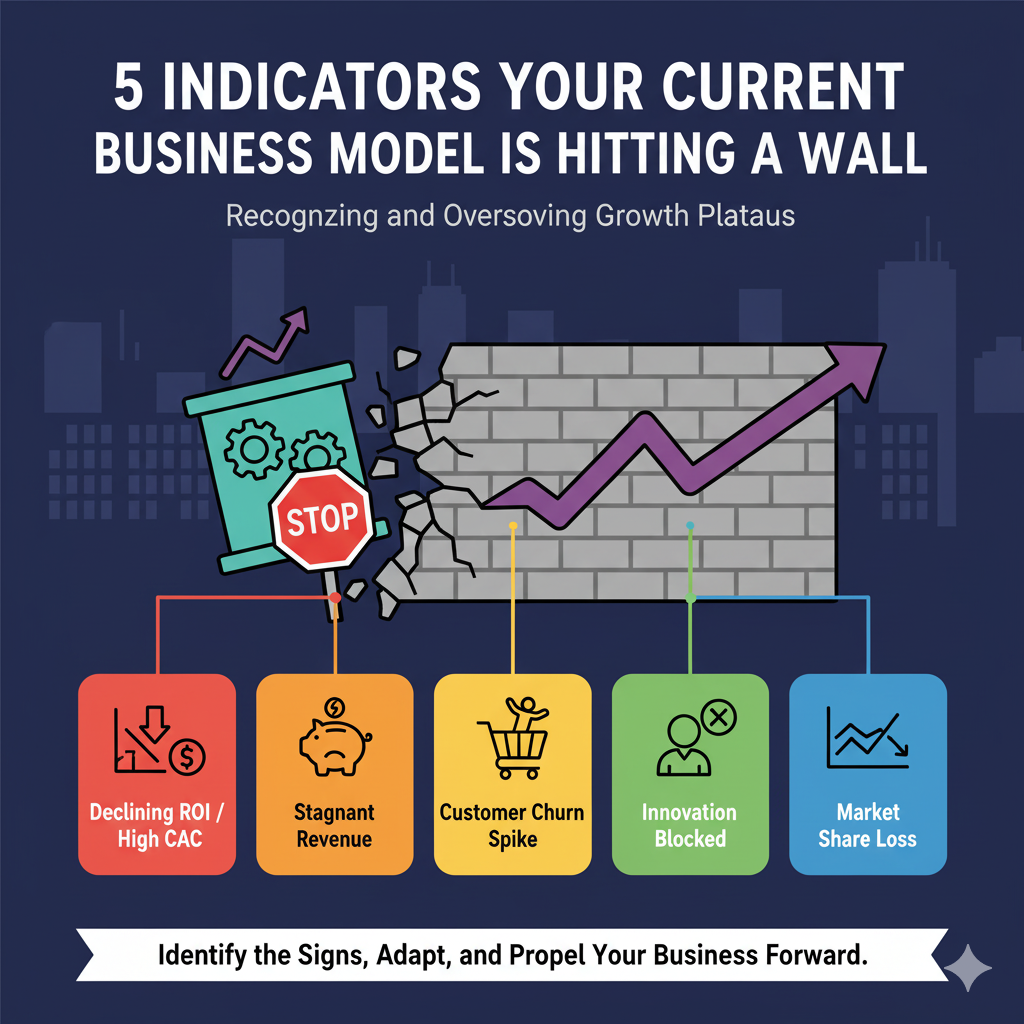

5 Indicators Your Current Business Model is Hitting a Wall

October 21, 20254 Mins read27 Views5 Indicators Your Current Business Model is Hitting a Wall

The success you’ve achieved with your current business model can blind you to its future limitations. Every scalable business model eventually encounters a growth ceiling, or a business model growth plateau, where the strategies that once worked stop yielding the same results. Ignoring these signs your business model is failing is the fastest path to stagnation.

To sustain genuine, scalable growth, you must move beyond vanity metrics and look at the cold, hard data. The moment your model starts to break down, the warning signs appear in your financial and operational reports. This guide identifies the five most critical indicators that necessitate a strategic pivot.

1. Declining LTV:CAC Ratio (The Profitability Stress Test)

The LTV:CAC ratio is the single most important metric for long-term sustainability. It measures the total Customer Lifetime Value against the Customer Acquisition Cost.

The Signal: The ratio is trending downwards, moving from the ideal 3:1 toward 1:1.

Why It Matters: A declining ratio means your business is becoming increasingly inefficient. It’s either costing you more to acquire a customer (rising CAC) or your customers are worth less over time (falling LTV).

- LTV Problem: Customers are churning faster or not upgrading to higher tiers. This signals a product or value-capture issue.

- CAC Problem: Ad costs are rising due to audience saturation, or your sales team is spending more resources on unqualified leads.

If you are spending $1 to acquire a customer who only yields $1.50 in value, your entire model is broken. This indicator provides the financial justification for an immediate pivot.

2. Flat or Declining ARPU with High New Customer Volume

Average Revenue Per User (ARPU) measures how much value you capture from each customer. It’s the litmus test for expansion revenue.

The Signal: Your total customer count is increasing, but your ARPU remains flat quarter-over-quarter.

Why It Matters: A flat ARPU suggests that your current pricing and packaging actively prevent your revenue from scaling with your customers’ success. You are failing at ARPU optimization.

- Lack of Upsell: Your customers are not graduating to higher-priced tiers, or they have no incentive to do so. This can be fixed by shifting to a usage-based or value-based pricing model that automatically scales as the customer grows.

- No Cross-Sell: You haven’t successfully launched complementary products or services to your existing base, forcing you to rely solely on new, costly customer acquisition for revenue growth. This indicates that your revenue streams are too narrowly focused.

3. Rising Churn Concentrated in Specific Segments

A rising churn rate is the most common of all signs your business model is failing, but a strategic pivot requires understanding where the churn is happening.

The Signal: Your overall churn rate is increasing, and recurring revenue analysis shows that this loss is disproportionately high among a specific demographic, industry, or customer size (e.g., all your small business clients churn within 6 months).

Why It Matters: This signals a fundamental product-market fit failure for that particular segment. Your business model may be perfectly suited for mid-market clients but completely misaligned with the needs, budgets, and operational flows of smaller customers. The “one-size-fits-all” model is what’s hitting the wall. You must:

- Exclude the Segment: Stop wasting marketing and sales budget acquiring customers who are guaranteed to churn.

- Pivot the Model: Create a separate, specialized model (e.g., a “freemium” or low-cost tier) specifically designed to serve that segment profitably, or exit the segment entirely.

4. Sales Cycle Length is Increasing Despite High Lead Quality

Operational indicators can often signal a problem before the financial reports do. The sales cycle length is a powerful forward-looking metric.

The Signal: The time it takes to convert a qualified lead into a paying customer is lengthening, causing a cash flow lag.

Why It Matters: This slowdown suggests your product or service is becoming too complex, too expensive, or too similar to competitors. Key reasons include:

- Feature Creep: Your product is overloaded with features, making the demo and decision-making process overly complicated for the buyer.

- High Initial Friction: Your model requires a massive upfront investment (in time, integration, or cost), making procurement difficult. A successful pivot here would involve reducing friction, perhaps offering a “land and expand” model with a cheaper, faster proof-of-concept phase.

- Increased Stakeholder Involvement: More people have to sign off on the purchase, indicating the product is moving from a tactical tool to a complex, multi-departmental investment.

5. Stagnation in Total Addressable Market (TAM) or Market Size

While the other indicators are internal, this one is external, and it suggests your model has exhausted its natural customer base.

The Signal: Your acquisition cost is soaring, and customer referrals are drying up, indicating you are pulling from the same well too often.

Why It Matters: The market you designed your product for is saturated. You have captured all the low-hanging fruit and are now battling with every competitor over the same pool of late adopters. Your business model may be limited by:

- Geographic Focus: You have exhausted your domestic market and need to expand your model to international territories.

- Product Offering: Your product solves a problem for a very specific type of user. You need to pivot to solve an adjacent, larger problem for a broader market (e.g., pivoting from a task management tool to an entire project collaboration suite).

Recognizing these five indicators is the key to mastering your business model growth plateaus. The data provides the clarity, but the pivot requires strategic courage. By proactively identifying these warning signs, you can transform a moment of stagnation into a blueprint for exponential growth.

More News

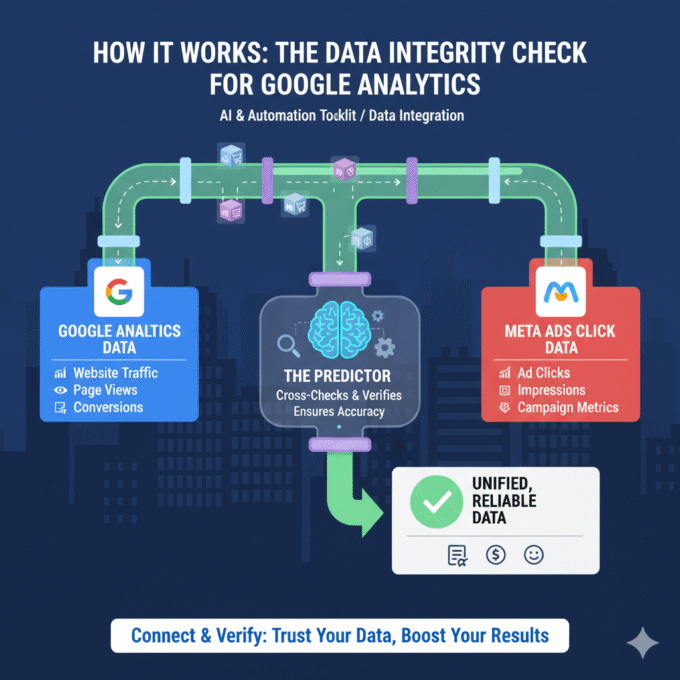

The Data Integrity Check for Google Analytics

How It Works: The Data Integrity Check for Google Analytics In the...

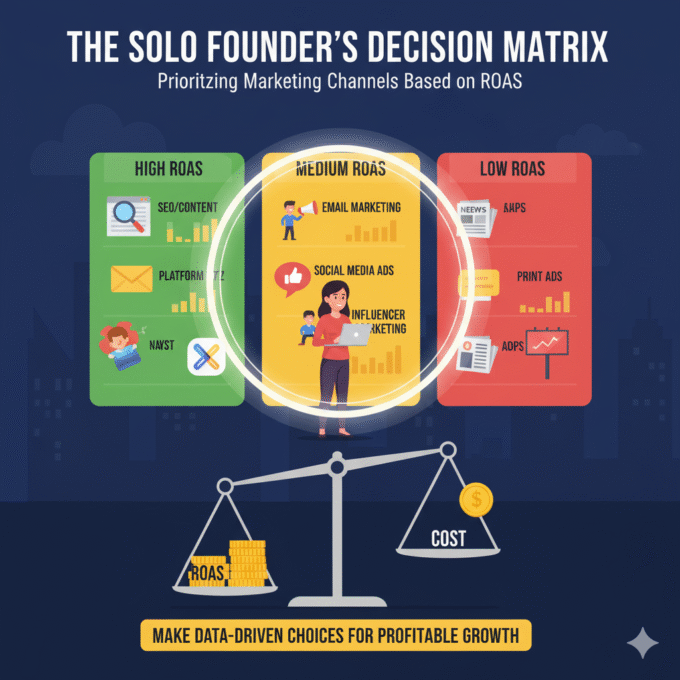

October 21, 2025The Solo Founder’s Decision Matrix: Prioritizing Marketing Channels Based on ROAS

The Solo Founder’s Decision Matrix As a solo founder, your most precious...

October 21, 20255 Indicators Your Current Business Model is Hitting a Wall

5 Indicators Your Current Business Model is Hitting a Wall The success...

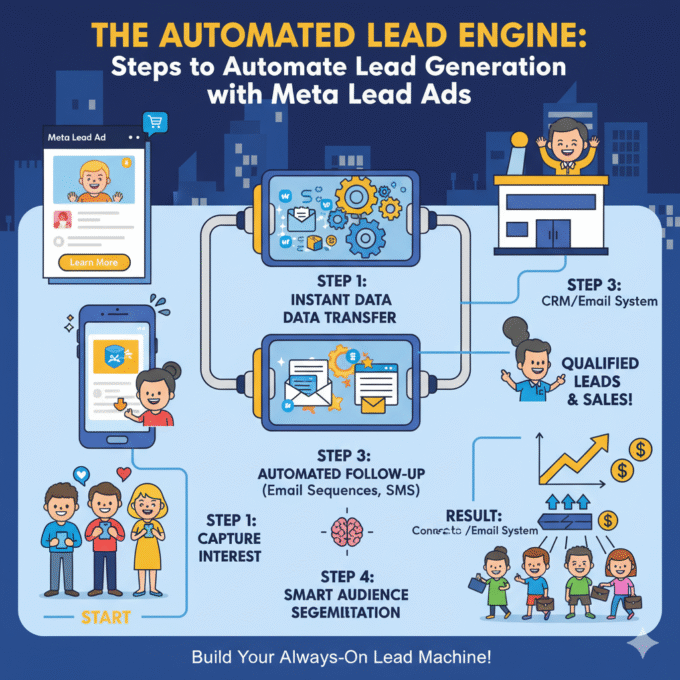

October 21, 2025The Automated Lead Engine: Steps to Automate Lead Generation with Meta Lead Ads

Steps to Automate Lead Generation with Meta Lead Ads Meta Lead Ads...

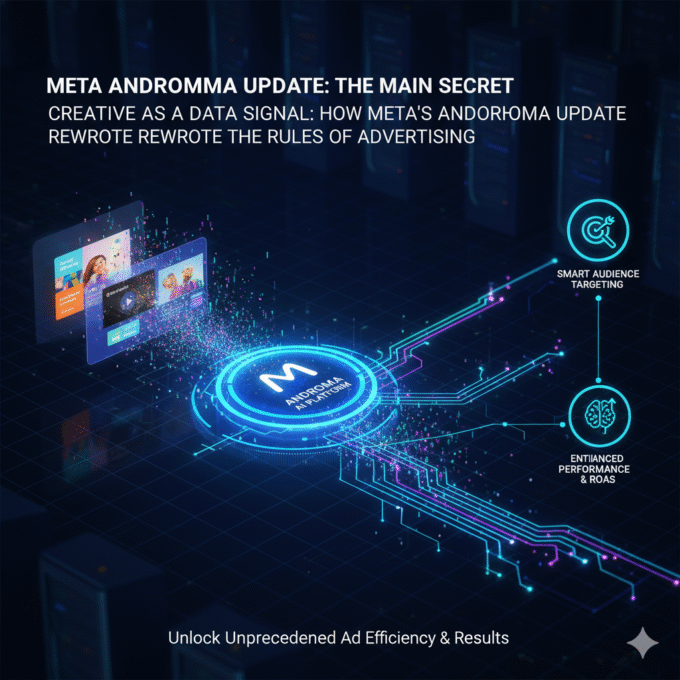

October 20, 2025META Andromeda update main secret

Creative as a Data Signal: How Meta’s Andromeda Update Rewrote the Rules...

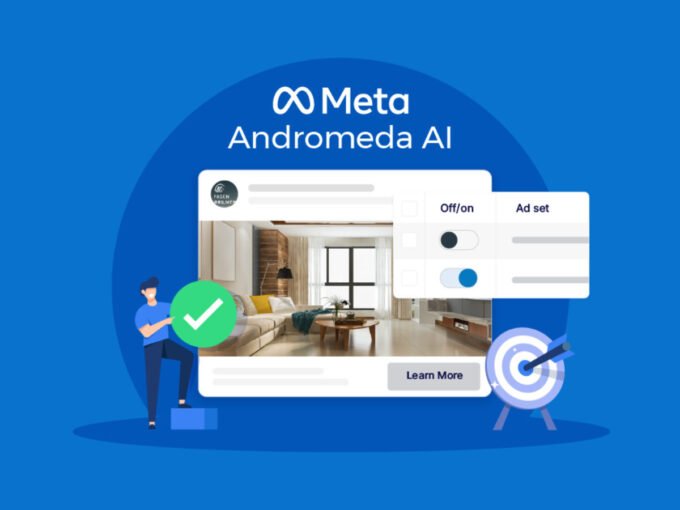

October 20, 2025Meta Andromeda: The Next-Generation AI Engine for Performance Growth

I. Executive Summary: The Andromeda Paradigm Shift 1.1. Introduction to the AI...

October 14, 2025The Data Integrity Check for Google Analytics

How It Works: The Data Integrity Check for Google Analytics In the...

October 21, 2025The Solo Founder’s Decision Matrix: Prioritizing Marketing Channels Based on ROAS

The Solo Founder’s Decision Matrix As a solo founder, your most precious...

October 21, 2025The Automated Lead Engine: Steps to Automate Lead Generation with Meta Lead Ads

Steps to Automate Lead Generation with Meta Lead Ads Meta Lead Ads...

October 20, 2025META Andromeda update main secret

Creative as a Data Signal: How Meta’s Andromeda Update Rewrote the Rules...

October 20, 2025