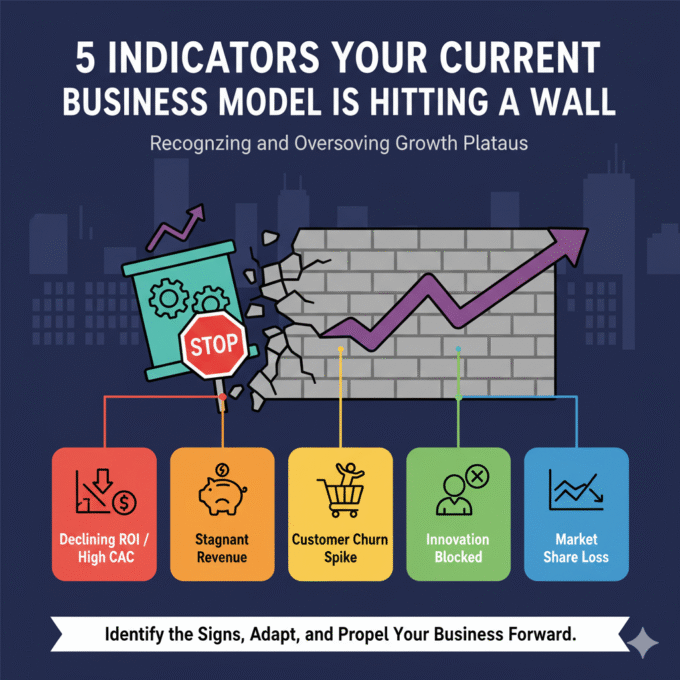

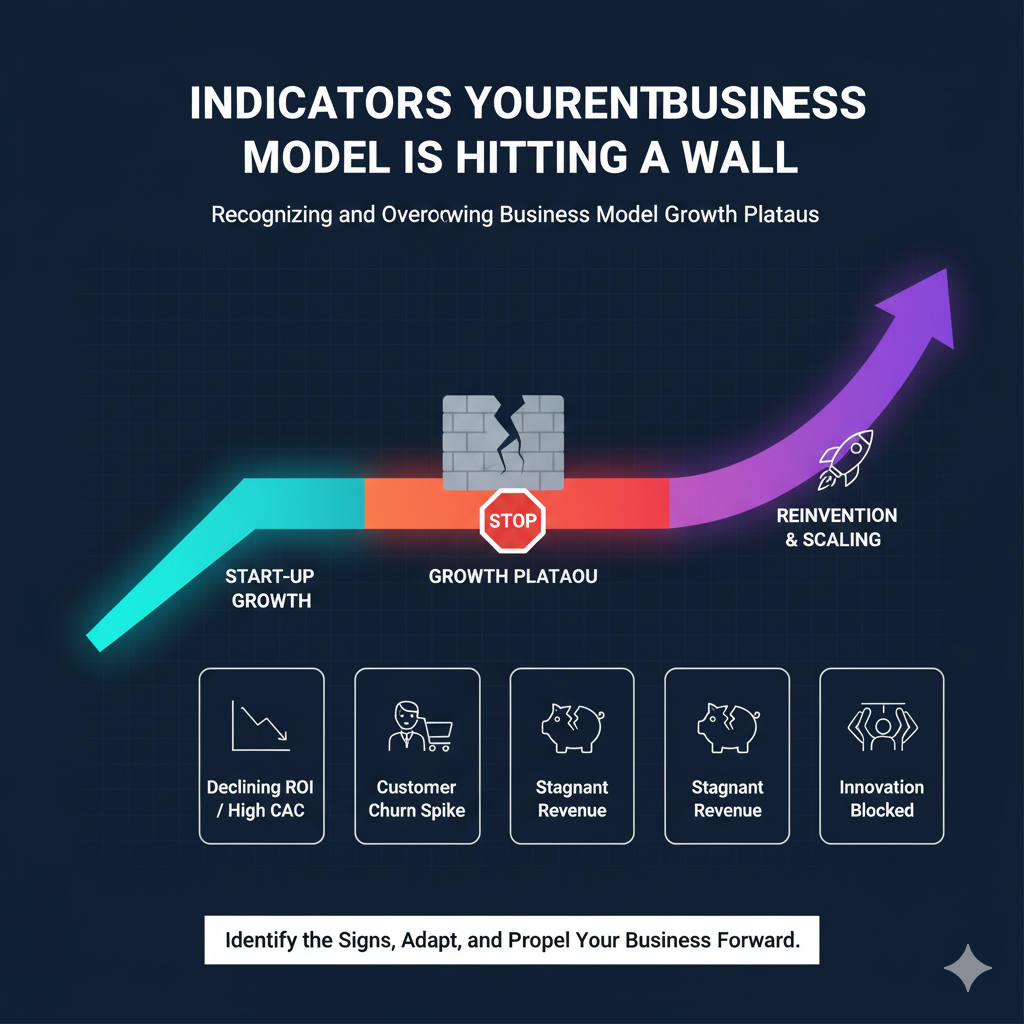

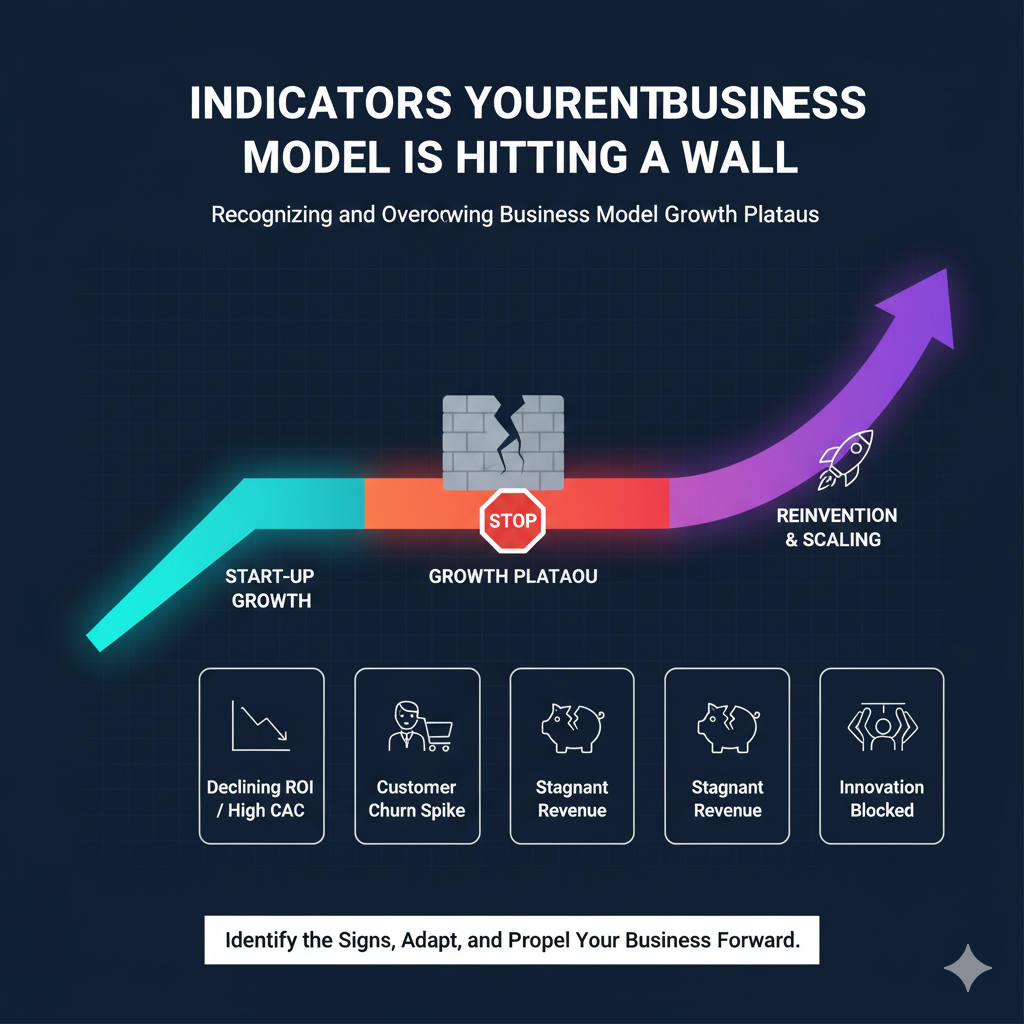

Indicators Your Current Business Model is Hitting a Wall: Recognizing and Overcoming Business Model Growth Plateaus

September 30, 20253 Mins read37 ViewsRecognizing and Overcoming Business Model Growth Plateaus

Every business owner dreams of a smooth, uninterrupted climb to the top. But the reality is that the very model that fueled your initial success can become a cage, limiting your potential and leaving you stalled. This frustrating period, often invisible to the untrained eye, is known as a business model growth plateaus. It’s not a sign of failure, but a clear signal that your company is ready for a fundamental shift.

Recognizing these signs your business model is failing is the first step toward a strategic pivot that can unlock a new phase of hyper-growth. This guide will provide a clear-eyed look at the critical financial and operational indicators you must monitor to get ahead of the problem and build a path forward.

The Financial Signals: 4 Key Indicators to Watch For

Your business’s data is a roadmap to its health, but you have to know where to look. These four metrics, taken together, can reveal the invisible wall that is holding you back.

1. Flat or Declining ARPU (Average Revenue Per User)

ARPU is a direct measure of the value you are capturing from each customer. It’s the simple average of the revenue you generate from each user or account over a given period. While a healthy ARPU is good, a flat or declining ARPU is a clear signal that your current model is not built for expansion.

A flat ARPU indicates that you are not successfully upselling or cross-selling to your existing customer base. You are relying solely on new customer acquisition to drive growth. This makes your business fragile. If new customer acquisition slows down, your entire revenue engine stalls. True growth comes from a combination of new logos and increased revenue from existing ones. This is why ARPU optimization is so critical for sustained growth.

2. Increasing Churn Rate

While new customer acquisition is exciting, a rising churn rate—the percentage of customers you lose over time—is a silent killer. In a healthy business, your churn rate should be stable and low. An increasing churn rate is a direct signal that your business model’s value proposition is weakening.

A rising churn rate can be a result of several factors:

- The Competition: Your competitors may have entered the market with a superior offering or a more attractive pricing model.

- Lack of Value: Your product is no longer meeting your customers’ evolving needs.

- Customer Mismatch: Your marketing and sales efforts are bringing in customers who are not a good fit for your product, leading them to leave quickly.

A high churn rate means your business is a leaky bucket, and any attempt to pour more water into it (through new customer acquisition) will ultimately fail.

3. The LTV:CAC Ratio is Trending Down

We’ve discussed the importance of the LTV:CAC ratio in a previous article. It’s the ultimate measure of your business’s financial health, comparing the lifetime value of a customer to the cost of acquiring them. When this ratio starts to decline, it is one of the clearest signs your business model is failing.

A declining LTV:CAC ratio means one of two things is happening (or both):

- Your LTV is decreasing: Your customers are spending less or leaving sooner. This can be caused by increasing churn, or a lack of successful upselling and cross-selling.

- Your CAC is increasing: It’s costing you more to acquire a new customer. This can be caused by rising ad costs, increasing competition, or a broken sales funnel.

In both scenarios, the result is the same: your business is becoming less profitable and less sustainable with every new customer you acquire.

4. Stagnating Recurring Revenue

For businesses with a recurring revenue model (like SaaS), consistent growth is the heartbeat of the company. Recurring revenue analysis is the key to understanding this. If your Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR) is flat—even if you are acquiring new customers—it points to a critical flaw in your model.

Stagnant recurring revenue means the new revenue from acquired customers is being offset by a combination of customer churn and a lack of expansion revenue (upsells). A truly healthy and scalable business sees its revenue increase from two sources:

- New Business: The acquisition of new customers.

- Expansion Revenue: The successful upselling and cross-selling to your existing customer base.

When expansion revenue is absent or negative, your business is not truly growing. It’s just treading water, and a single downturn in new customer acquisition could be catastrophic.

The Path Forward: Pivoting Your Business Model

Recognizing these business model growth plateaus is not a sign of defeat; it’s an opportunity for a strategic pivot. The data you have collected from analyzing these four metrics is the roadmap to a new, more sustainable model.

Perhaps a flat ARPU suggests you should move from a flat-rate model to a usage-based or tiered pricing structure. Maybe a rising churn rate means you need to re-evaluate your value proposition and improve your customer success efforts. The data will tell you if you need to optimize your acquisition channels or your retention strategies.

The journey to building a scalable business is not linear. By proactively monitoring these key indicators, you can get ahead of the problem and transform a growth plateau into a springboard for your next phase of growth. The alternative is a path of costly, reactive firefighting.

It’s time to stop ignoring the signals and start auditing your business model.

More News

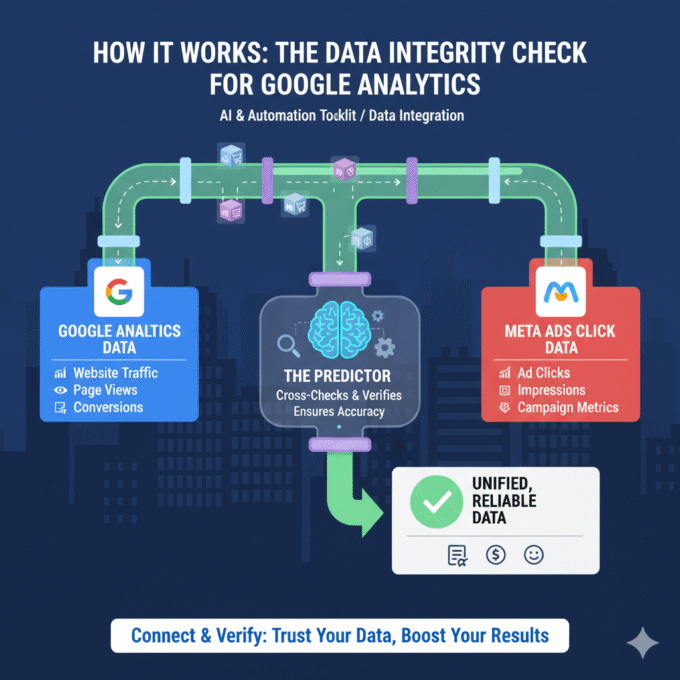

The Data Integrity Check for Google Analytics

How It Works: The Data Integrity Check for Google Analytics In the...

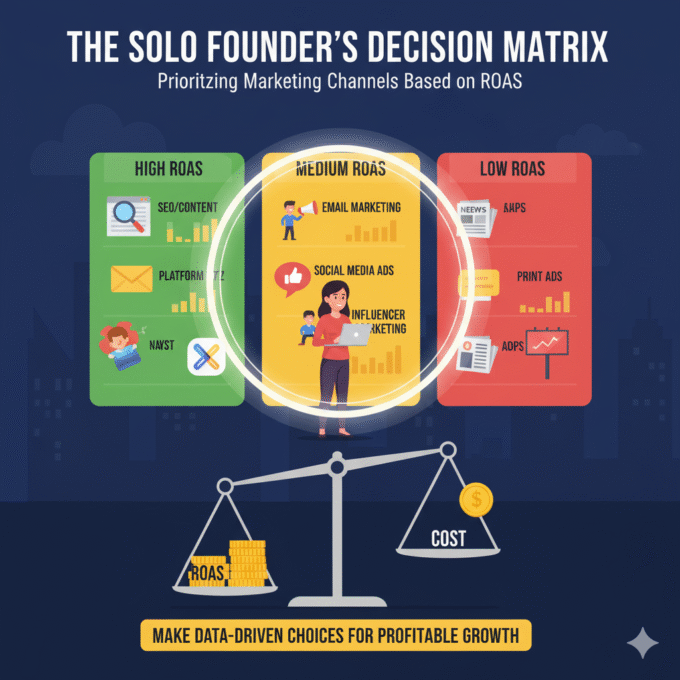

October 21, 2025The Solo Founder’s Decision Matrix: Prioritizing Marketing Channels Based on ROAS

The Solo Founder’s Decision Matrix As a solo founder, your most precious...

October 21, 20255 Indicators Your Current Business Model is Hitting a Wall

5 Indicators Your Current Business Model is Hitting a Wall The success...

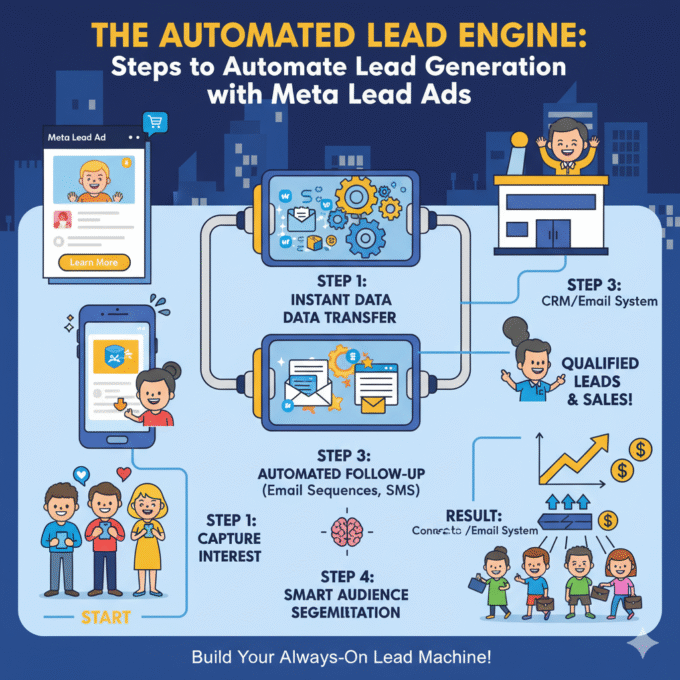

October 21, 2025The Automated Lead Engine: Steps to Automate Lead Generation with Meta Lead Ads

Steps to Automate Lead Generation with Meta Lead Ads Meta Lead Ads...

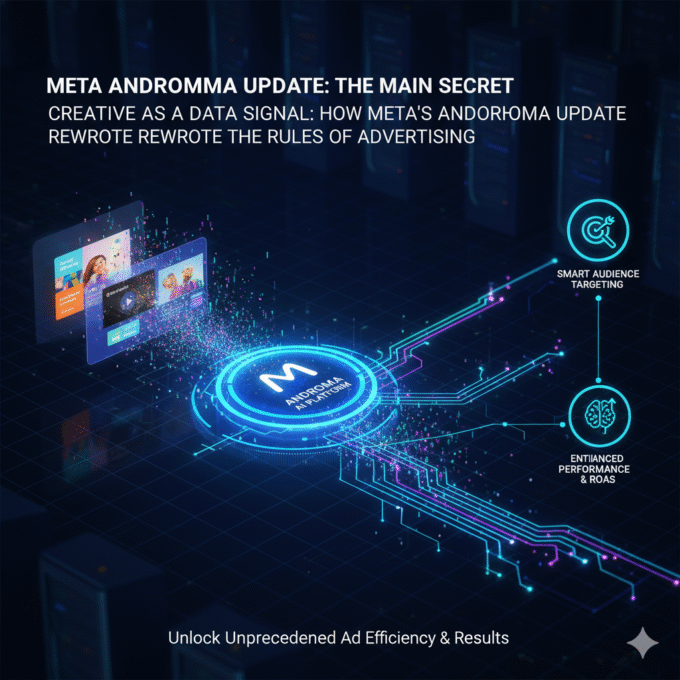

October 20, 2025META Andromeda update main secret

Creative as a Data Signal: How Meta’s Andromeda Update Rewrote the Rules...

October 20, 2025Meta Andromeda: The Next-Generation AI Engine for Performance Growth

I. Executive Summary: The Andromeda Paradigm Shift 1.1. Introduction to the AI...

October 14, 2025The Data Integrity Check for Google Analytics

How It Works: The Data Integrity Check for Google Analytics In the...

October 21, 2025The Solo Founder’s Decision Matrix: Prioritizing Marketing Channels Based on ROAS

The Solo Founder’s Decision Matrix As a solo founder, your most precious...

October 21, 20255 Indicators Your Current Business Model is Hitting a Wall

5 Indicators Your Current Business Model is Hitting a Wall The success...

October 21, 2025The Automated Lead Engine: Steps to Automate Lead Generation with Meta Lead Ads

Steps to Automate Lead Generation with Meta Lead Ads Meta Lead Ads...

October 20, 2025