Strategic Analysis of the $100M Money Model for Eliminating Cash Flow Constraints

October 9, 20254 Mins read29 Views

Strategic Analysis of the $100M Money Model for Eliminating Cash Flow Constraints

I. Executive Summary: Cash Flow as the Ultimate Constraint

The $100M Money Model, a strategic and financial architecture, addresses the single greatest threat to business sustainability: the depletion of cash flow.1 The methodology is built on the premise that failure in business is rarely due to a lack of effort or a poor product, but rather the structural inability to generate timely revenue that outpaces expenditure. A staggering 82% of business failures are attributed to poor cash flow management.1

This framework moves beyond basic sales tactics by engineering a precise sequence of offers designed to create a self-sustaining customer acquisition loop. The ultimate goal is to ensure that cash is removed as a bottleneck to scaling, allowing a business to grow exponentially, limited only by its operational capacity.

The model relies on four interdependent mechanisms—Attraction, Upsell, Downsell, and Continuity—leveraged to maximize the speed and volume of cash conversion from new customers.

II. The Financial Imperative: Engineering Client-Financed Acquisition

The defining characteristic of a successful $100M Money Model is its ability to transform Customer Acquisition Cost (CAC) from a liability into a dynamic, self-funding resource. This state is achieved through Client Financed Acquisition (CFA), a mechanism that requires rigorous financial discipline.

A. The 30-Day Growth Formula

For growth to be truly unconstrained, the business must generate a significant gross profit buffer upfront. The system operates on a simple but powerful mathematical principle, known as the 30-Day Growth Formula:

This formula dictates that every new customer must generate enough profit within the first 30 days to cover their own acquisition and fulfillment costs, and generate a surplus large enough to fund the acquisition of two more future customers.1 This removes the constraint of cash flow, allowing the business to scale immediately and infinitely.

B. The Mechanism of Client Financed Acquisition (CFA)

CFA is the operationalization of the 30-Day Growth Formula. It is the state where the gross profit derived from a new customer is sufficient to cover the total cost of acquisition and fulfillment within the initial 30 days.2

This 30-day timeline is crucial as it correlates with the typical interest-free period offered by business credit cards.2 By achieving profitability within this window, the business can pay off its initial acquisition expenditures before interest accrues, effectively securing continuous, free capital for perpetual ad scaling. This process—acquiring customer, collecting cash, paying debt, repeating—is how money is turned into a catalyst for unlimited growth.2

C. Metric Mastery: LTGP vs. LTV

The framework emphasizes tracking Lifetime Gross Profit (LTGP) rather than the more common, but misleading, Lifetime Value (LTV).2 LTGP, calculated as total revenue minus the variable costs of fulfilling the product or service, measures true unit profitability.

A critical benchmark for sustainable scaling is the 3:1 LTGP:CAC ratio.4 Achieving this ratio provides the necessary margin to absorb operating overhead, fulfillment costs, and the inevitable inflation of advertising expenditure, ensuring profitability is secured after acquisition costs are factored in.4

III. The Four Core Mechanisms of Monetization

The $100M Money Model is built on a precise sequence and layering of four offer types, designed to maximize cash conversion from every prospect.

A. Attraction Offers

Attraction Offers serve as the irresistible front door, designed solely to prompt the customer’s first purchase or commitment.1 They are frequently free or deeply discounted, with the primary strategic goal being to convert a prospect into a paying customer—the actual profit is derived from subsequent offers.1

| Mechanism | Definition | Case Study Example | Citation |

| Win Your Money Back | Customer pays full price upfront, but is offered a full refund as store credit if they achieve a specific goal. | A gym required customers to pay $500 upfront for a challenge; if successful, they received the $500 back as credit toward a membership. This generated $200 cash positive on day one, funding expansion. | 1 |

B. Upsell Offers

Upsell Offers are strategically presented immediately after the initial purchase to maximize immediate transaction value.1 They encourage the customer to spend more by offering a better version, a larger quantity, or a complementary product that enhances the value of the initial commitment.1

| Mechanism | Definition | Case Study Example | Citation |

| Four-Part Menu Upsell | A structured dialogue used to boost sales: Unsell (build trust by saying what they don’t need), Prescribe (recommend only what they do need), Offer A or B (force a choice between two good options), and Make it Easy (simplify payment). | Prestige Labs used this script to increase monthly revenue from $270,000 to $1.6 million in eight weeks by transforming how gyms sold supplements. | 1 |

C. Downsell Offers

Downsell Offers are employed to salvage revenue when a customer says “no” to the initial core offer or a subsequent upsell.1 By shifting the terms of the trade, they capture cash that would otherwise be lost.1

| Mechanism | Definition | Examples | Citation |

| Payment Structure Adjustment | Offering the same product/value but changing how the customer pays to fit their immediate financial constraint. | Payment plans, trial offers, or flexible installment arrangements. | |

| Feature Modification | Offering a lower price by reducing the quantity or removing non-essential features/services. | Feature-limited packages or smaller quantities of the core product. |

D. Continuity Offers

Continuity Offers are the key to long-term stability, designed to generate recurring, predictable, and stacking revenue through memberships, subscriptions, or retainers.

| Mechanism | Definition | Case Study Example | Citation |

| Continuity Bonus Offer | Offering a highly valuable bonus for free, contingent upon the customer joining a recurring/continuity program. | Gym Launch offered an incredibly valuable bonus only if the customer joined the recurring program. This increased customer retention and scaled average customer value, causing revenue to explode from $380,000/month to $1.76 million/month in six months. | 1 |

IV. Conclusion: Building the Unkillable Business

The $100M Money Model provides a sophisticated blueprint for achieving self-funded growth. By rigorously applying the sequencing of offers and adhering to the 30-Day Growth Formula, a business can achieve Client Financed Acquisition, eliminating the cash flow limitation that stifles 82% of businesses.1

The foundational principle of this financial architecture is compound growth: if a business can make its customers twice as valuable, get twice as many of them, and get them to pay you at twice the speed, the business grows eight times as fast.1 The sequencing of Attraction, Upsell, Downsell, and Continuity Offers is the tactical map for achieving this exponential result.

More News

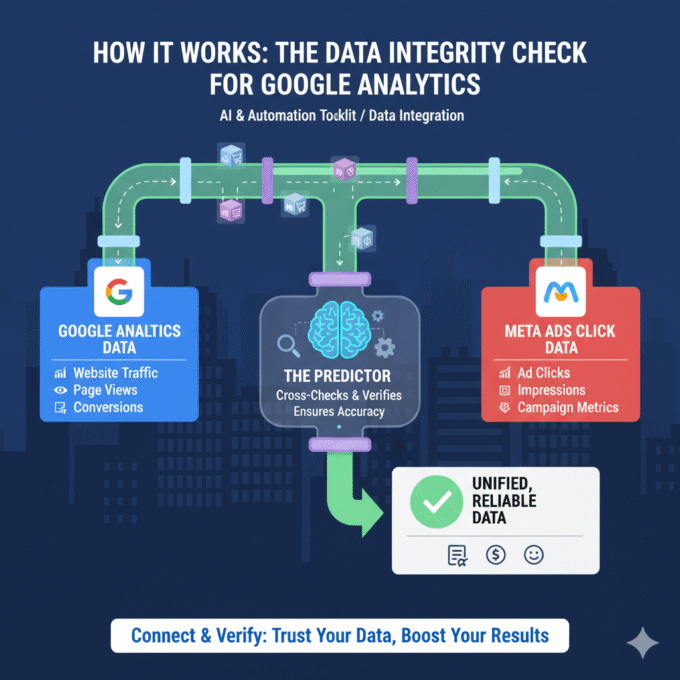

The Data Integrity Check for Google Analytics

How It Works: The Data Integrity Check for Google Analytics In the...

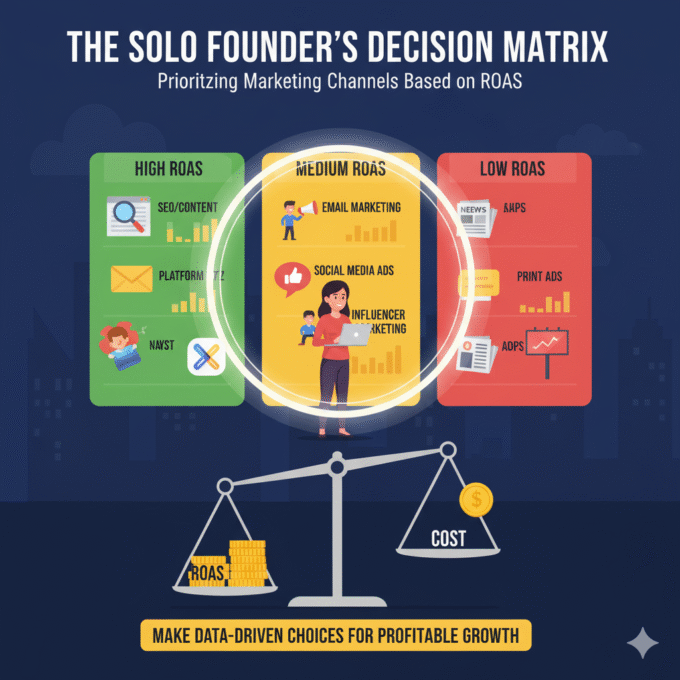

October 21, 2025The Solo Founder’s Decision Matrix: Prioritizing Marketing Channels Based on ROAS

The Solo Founder’s Decision Matrix As a solo founder, your most precious...

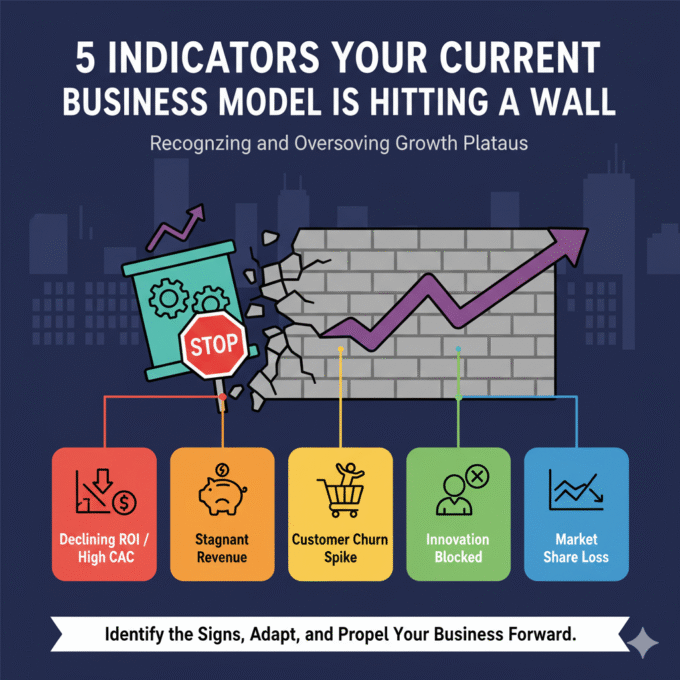

October 21, 20255 Indicators Your Current Business Model is Hitting a Wall

5 Indicators Your Current Business Model is Hitting a Wall The success...

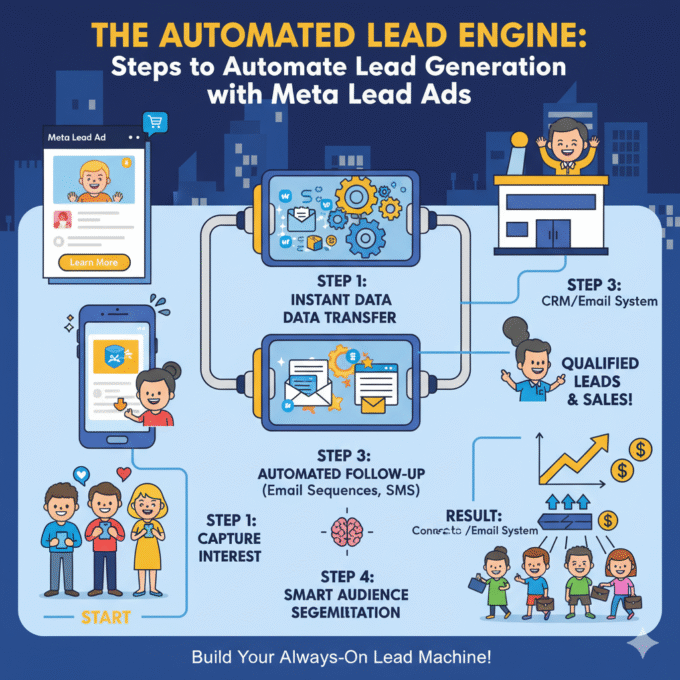

October 21, 2025The Automated Lead Engine: Steps to Automate Lead Generation with Meta Lead Ads

Steps to Automate Lead Generation with Meta Lead Ads Meta Lead Ads...

October 20, 2025META Andromeda update main secret

Creative as a Data Signal: How Meta’s Andromeda Update Rewrote the Rules...

October 20, 2025Meta Andromeda: The Next-Generation AI Engine for Performance Growth

I. Executive Summary: The Andromeda Paradigm Shift 1.1. Introduction to the AI...

October 14, 2025The Data Integrity Check for Google Analytics

How It Works: The Data Integrity Check for Google Analytics In the...

October 21, 2025The Solo Founder’s Decision Matrix: Prioritizing Marketing Channels Based on ROAS

The Solo Founder’s Decision Matrix As a solo founder, your most precious...

October 21, 20255 Indicators Your Current Business Model is Hitting a Wall

5 Indicators Your Current Business Model is Hitting a Wall The success...

October 21, 2025The Automated Lead Engine: Steps to Automate Lead Generation with Meta Lead Ads

Steps to Automate Lead Generation with Meta Lead Ads Meta Lead Ads...

October 20, 2025