Alex Hormozi’s 100M Leads

October 9, 202513 Mins read31 ViewsStrategic Analysis of the $100M Leads Framework for Perpetual, Capital-Efficient Acquisition

I. Executive Summary: The Strategic Imperative for Perpetual Lead Flow

The $100M Leads methodology, developed by Alex Hormozi, transcends simple marketing tactics, presenting itself as a holistic, self-sustaining financial and operational system engineered to secure predictable lead flow and eliminate cash flow dependencies in scaling customer acquisition. The framework operates on the foundational principle that high-volume, repeatable lead generation is the definitive mechanism for creating wealth in business.

The system relies on a critical prerequisite: the prior establishment of a superior value proposition, often referred to as a “Grand Slam Offer”.1 Offer excellence is the prerequisite for achieving lead flow sufficiency, which, in turn, enables the primary financial mechanism of the system: Client Financed Acquisition (CFA). Without a compelling offer that minimizes customer attrition and maximizes profitability, sustained acquisition efforts are prohibitively costly.

The central problem addressed by this framework is the widespread tendency for businesses to suffer from inconsistent advertising effort and insufficient lead flow, which ultimately caps growth.2 The $100M Leads solution is a highly disciplined, multi-channel approach that prioritizes predictable, profitable scaling over merely chasing high-volume traffic. This ensures that every lead generation effort is perpetually capital-efficient. Growth is explicitly dual-pathed, achieved by both increasing the volume of incoming leads and systematically increasing the value derived from those leads.2

A. Defining the Engaged Lead

In this context, a lead is technically defined as “a person you can contact,” which can encompass various data points such as an email address, a LinkedIn connection, or contact information captured from a website visitor.3 However, the strategic emphasis is placed on the Engaged Lead—a prospect who has voluntarily consumed free, high-value content (such as a superior lead magnet) and has demonstrated clear intent. This initial engagement builds a relationship of trust, making the prospect significantly more receptive to future sales asks and lowering the subsequent conversion effort required by the organization.4

B. The Foundational Mindset: Endurance and Compounding

The strategic execution of the $100M Leads system is underpinned by a philosophy of patience and sustained, systematic effort. The advice is to “play games where if you wait, you win”.4 This mandates a shift away from seeking rapid, short-term success toward an endurance-based strategy rooted in consistent execution. The core belief integrated into the organizational structure is the principle that sustained action eliminates the possibility of failure: “You cannot lose if you do not quit.” Success is viewed as the probabilistic outcome of continuous iteration and commitment across defined channels, rather than relying on single, breakthrough campaigns.5

II. Core Operational Playbook: The Core Four Lead Generation Methods

The Core Four framework provides a clear, sequential progression for generating leads, organized to systematically move a business from high-trust, zero-cost acquisition to high-leverage, scaled paid channels. This sequence is explicitly designed to validate the business model and offer effectiveness before significant capital expenditure is required.

A. Sequencing and Principles of the Core Four

Hormozi structures the expansive world of marketing into four manageable, distinct categories: Warm Outreach, Posting Free Content, Cold Outreach, and Running Paid Ads.4 The prescribed sequence mitigates risk: Warm outreach validates the conversion mechanics; free content validates the organization’s ability to communicate value one-to-many; and only after these systems are proven does the business graduate to large-scale, cost-intensive paid advertising.

1. Warm Outreach (Sequence 1)

This initial phase leverages existing personal networks and trust to acquire the first cohort of clients.4 The technique is strategically non-pitch based. Instead of directly selling to contacts, the approach involves asking personal connections who they know that would benefit from the service. This preserves crucial social capital while generating referrals that are inherently high-quality due to the embedded trust transfer.4

2. Posting Free Content (Sequence 2)

Once the first clients are secured, the focus shifts to consistent content creation. The operational principle here is to build an audience that functions as a compounding asset.4 Content must share what has successfully worked for the business or the founder (“How I” content rather than generic “How To” content). A high standard of “value per second” must be maintained to maximize retention and continuously feed the high Give:Ask ratio required to nurture a warm audience.4

3. Cold Outreach (Sequence 3) and Running Paid Ads (Sequence 4)

These two methods are categorized together as they target strangers who do not possess pre-existing trust in the brand.4 Consequently, success depends entirely on attention capture (the Hook) and the persuasive power of the core offer. Both methods require constant repetition, ensuring the message reaches prospects “again and again” until a purchase is initiated.4 Paid advertisements represent the ultimate means of scaling lead generation rapidly, provided the financial engine (CFA) is optimized and proven to be profitable.8

The Core Four Lead Generation Strategy Map provides a structured view of these channels:

The Core Four Lead Generation Strategy Map

| Strategy Type | Audience Trust Level | Communication Leverage | Primary Objective | Risk/Cost Profile |

| Warm Outreach | High (Existing Network) | One-to-One | Immediate first clients and offer validation. | Low Cost, High Time |

| Posting Free Content | Medium (New/Existing) | One-to-Many | Authority building and growing the compounding asset (audience). | Low Cost, High Time |

| Cold Outreach | Low (Strangers) | One-to-One/Many | Direct prospect initiation based on aggressive offer. | Medium Cost, High Time |

| Running Paid Ads | Low (Strangers) | One-to-Many | Rapid, repeatable scaling upon financial validation. | High Cost, Low Time (Scalable) |

B. The Rule of 100: Establishing Execution Metrics

The Rule of 100 is implemented as a compulsory execution floor, ensuring mechanical consistency across all lead generation efforts.4 This mandate dictates specific daily metrics, such as reaching out to 100 people, dedicating 100 minutes to content creation, or spending $100 on paid advertisements.4 This daily discipline is designed to counteract the sporadic nature of typical entrepreneurial efforts. By formalizing execution, the Rule of 100 compels the consistent collection of data, which is necessary to inform the Better stage of scaling later in the process.

C. The Growth Vector: More, Better, New Iterative Scaling

The framework rigorously defines the pathway for scaling lead volume, prioritizing actions based on impact, risk, and sequential efficiency.4

The first and often most overlooked option is to Do More of what is currently effective. This involves increasing the sheer volume of execution, primarily by adhering to the Rule of 100. This phase relies heavily on establishing operational processes (such as the 3Ds model, detailed below) to handle increased volume without sacrificing quality.4

Once the volume is maximized, the business must pivot to Do Better. This involves optimizing conversion rates by meticulously tracking metrics to identify and rectify drop-off points within the acquisition funnel. This stage demands metric mastery, particularly the optimization of the Customer Acquisition Cost (CAC).4

The final step is to Add New strategies. This means diversifying channels by adding new placements or platforms within the current strategy (ee.g., adding YouTube if blogging is the current strategy), or, finally, introducing another one of the Core Four methods.4 The hierarchy (More Better New) mandates that a business must first achieve operational efficiency and cost optimization before capital diversification is justified.

III. The Financial Engine: Client-Financed Acquisition and Profitable Scale

For an investor or scaling executive, the most critical element of the $100M Leads framework is the strategic financial model that governs resource allocation and scalability, centered on the Lifetime Gross Profit (LTGP) metric and the Client Financed Acquisition (CFA) mechanism.

A. Metric Mastery: Lifetime Gross Profit (LTGP) vs. LTV

The system demands the use of Lifetime Gross Profit (LTGP) rather than the widely used Lifetime Value (LTV). LTGP is calculated as the total revenue generated by a customer over their entire purchasing lifespan, minus the variable cost of fulfilling the product or service.9 LTV often includes overhead and operational expenses, resulting in an overly optimistic figure that is misleading for cash flow analysis. LTGP measures true unit profitability, providing a far clearer indication of the actual cash available to reinvest in future customer acquisition.5 This strategic shift enables scaling decisions to be based on validated cash flow capacity, mitigating the risk inherent in theoretical projections.

B. The 3:1 LTGP:CAC Ratio Threshold

The minimum acceptable financial benchmark for sustainable, scalable growth is the 3:1 LTGP:CAC ratio.5 This ratio serves as the stability benchmark in competitive markets. If a business operates below this threshold—for instance, at a 2:1 ratio, which is common among high-turnover agencies 5—it implies that 50% or more of the gross profit is consumed purely by customer acquisition costs.

The 3:1 margin is designed to provide the necessary buffer to absorb: 1) Fulfillment costs not included in LTGP calculation, 2) Fixed overhead and operational expenses, and 3) A margin of safety against the inevitable inflation of ad costs (CAC).9

Strategic decisions on resource allocation are determined by where the ratio is suboptimal:

- If the CAC is determined to be high (e.g., exceeding 3x the industry average), the focus must be directed toward improving advertising effectiveness, such as creative refinement or media buying optimization.

- If the CAC is competitive or low, focus must pivot to optimizing the business model itself, specifically increasing LTGP through methods like retention improvement or strategic upsells.9

C. Mechanism of Client Financed Acquisition (CFA)

Client Financed Acquisition (CFA) is the state achieved when the gross profit derived from a newly acquired customer is sufficient to cover the total cost of acquisition and fulfillment within the initial 30 days.9

The 30-day timeline is a crucial element of cash flow leverage, as it corresponds directly to the typical interest-free period offered by business credit cards. By achieving profitability within this window, the business can pay off its initial acquisition expenditures, effectively securing continuous, interest-free capital for perpetual ad scaling.10 This status transforms money from a structural bottleneck into a dynamic catalyst for scaling.10

To engineer CFA status when initial profitability is marginal, specific financial tactics are employed. For example, implementing an immediate upsell with high-profit margins (e.g., 100% margin). If one in five new customers takes a $100 upsell, this adds an average of $20 in gross profit per customer, manipulating the initial 30-day LTGP to meet the cost coverage threshold.9

Critical Financial Metrics for Scaling

| Metric | Definition | Hormozi Threshold | Strategic Function | Analytical Significance |

| LTGP | Lifetime Gross Profit | N/A | Total revenue minus fulfillment cost over customer lifespan. | Focuses scaling on true unit profitability, avoiding LTV optimism. |

| CAC | Customer Acquisition Cost | N/A | Total marketing and sales expenditure to acquire one customer. | Determines channel efficiency and required offer performance. |

| LTGP:CAC Ratio | Profit Efficiency | Minimum 3:1 | Required buffer to ensure profitability after CAC and operating costs. | Acts as the stability benchmark for competitive ad environments. |

| CFA Status | Client Financed Acquisition | Cost covered in first 30 days | Ability to recycle capital perpetually using 30-day credit terms. | Eliminates cash flow as the constraint on scaling volume. |

IV. Tactical Frameworks for Conversion and Standardization

The ability to generate $100M worth of leads is not achieved through haphazard execution but through the deployment of repeatable, standardized tactical frameworks that maximize content effectiveness and minimize operational variability.

A. Content Unit Architecture (Hook, Retain, Reward)

This framework provides a clear structure for creating the high-performing free content necessary for Sequence 2 (Posting Free Content).

The Hook is the foundational element, designed to capture attention immediately and redirect it from other activities.9 The effectiveness of the Hook is quantified by the percentage of people who start consuming the content, making it a measurable metric.9 In an environment saturated with content, the failure of the Hook represents the single point of failure, nullifying the entire investment in content creation.

The Retain phase utilizes pacing and strategic presentation to maintain viewer engagement throughout the piece. Finally, the Reward is the delivery of the value promised by the Hook, which often precedes a soft ‘Ask’ designed to move the engaged lead further down the funnel.7

B. The Give:Ask Ratio

To cultivate an audience that functions as a valuable, compounding asset, the content strategy must heavily prioritize the delivery of massive value (the Give) over direct sales appeals (the Ask).7 A high Give:Ask ratio ensures the audience trusts the brand and remains receptive.

Monetization is implemented in one of two ways. It can be Integrated, where subtle advertising or calls-to-action are present in every piece of content, provided the value delivery maintains a high ratio. Alternatively, it can be Intermittent, where numerous pieces of “pure give” content are followed occasionally by an “ask” piece, such as a 10:1 ratio of value to promotion.7

C. Process Duplication: The 3Ds Model

The 3Ds model (Document, Demonstrate, Duplicate) is the operational methodology specifically designed to standardize and transfer essential business processes, particularly in lead generation, from the founder to new hires. This process is essential for scaling capacity without compromising execution quality.

- Document (Step One): The expert executes the task while concurrently writing down the steps precisely as they occur, resulting in a checklist or Standard Operating Procedure (SOP). This creates the first draft of the process.5

- Demonstrate (Step Two): The expert performs the checklist in front of the employee. Crucially, any time the employee slows down, pauses, or asks a question, the checklist is immediately updated to include the necessary detail. This refinement yields the second, more robust draft.5

- Duplicate (Implied): The employee executes the now standardized and refined SOP autonomously.

The operational significance of the 3Ds is its capacity to standardize competence. By capturing and duplicating optimized performance, it prevents the inevitable “competence creep” where new hires dilute overall organizational performance due to inconsistent, non-systematized execution. This mechanism is critical for the “Do More” stage of scaling, ensuring that increased volume does not lead to operational decline.

V. Exponential Lead Flow: Mastering the Four Lead Getters

Beyond the direct execution of the Core Four, massive lead flow requires leveraging external entities to generate prospects. These “Lead Getters” provide nonlinear growth capacity by having “other people can let them know using the core four”.10 This strategic delegation saves significant internal time and results in “more engaged leads for less work”.10

The Four Lead Getters serve as structured means to outsource or amplify the execution of the Core Four methods, enabling genuine scale.

A. Detailed Analysis of the Four Lead Getters

1. Customers/Referrals (The Product Leverage)

This mechanism focuses on encouraging satisfied customers to refer new prospects, typically using financial incentives.8 The effectiveness of a referral program is fundamentally dependent on the quality of the product or service itself, which must be superior enough to drive down churn and incorporate customer feedback.4 For maximum impact, the request for a referral must be systematized and made at the peak of goodwill—for example, immediately after purchase, by asking for a three-way introduction via text or email, rather than just requesting a list of names.4 This generates high-trust leads that require less marketing expense later.

2. Employees (The Internal Leverage)

Training internal sales teams and staff to proactively seek and qualify leads is a critical scaling step.8 The success of employee-driven lead generation is directly dependent on the successful implementation of the 3Ds model (Section IV-C). The 3Ds ensure that the outreach, follow-up, and qualification processes are standardized and repeatable, preventing chaos and maintaining high conversion rates as the sales team expands.5

3. Agencies (The Expertise and Capital Leverage)

Agencies are utilized to outsource highly complex or specialized lead generation tasks, such as sophisticated media buying or creative development.8 The strategic decision to utilize an agency usually occurs when internal attempts at CAC optimization stall, or when the required scale demands dedicated, niche expertise that the business cannot yet afford to hire full-time.5 This is only viable if the business has achieved a robust LTGP:CAC ratio that can comfortably absorb the agency’s management fees.

4. Affiliates and Partners (The Audience Leverage)

This involves collaborating with external entities through commission structures to share audiences and mutually generate leads.8 Affiliates provide exponential growth capacity by accessing markets and demographics that the company’s internal Core Four efforts cannot efficiently penetrate, offering non-linear reach and diversification of lead sources.

Lead Getters and Their Leverage Mechanisms

| Lead Getter | Primary Leverage Mechanism | Operational Prerequisite | Impact on Scaling |

| Customers/Referrals | Trust and Social Proof | Superior Product/Offer Quality (Low Churn) | Generates high-trust leads, reducing subsequent CAC and sales friction. |

| Employees | Internal Alignment/Time Saved | Standardized SOPs (3Ds Implementation) | Allows founder tasks to be delegated and multiplied linearly. |

| Agencies | Specialized Expertise/Capital Efficiency | High LTGP:CAC ratio (ability to afford external management fees) | Enables rapid scaling in complex channels (Paid Ads) without deep internal expertise. |

| Affiliates/Partners | Shared Audience/Market Reach | Attractive Commission/Offer Structure | Provides exponential, non-linear access to diverse external audiences. |

VI. The Organizational Scaling Roadmap and Strategic Shifts

Scaling successfully requires that the lead generation strategy evolves in tandem with organizational maturity. The framework details a clear roadmap that maps business size and complexity to the required advertising focus, systematically moving from solo execution toward specialized corporate delegation.

A. Mapping Business Maturity to Lead Strategy

The scaling progression mandates sequential growth, starting with personal efforts and moving toward systematized external leverage.4

- Level 1 (Founding): The primary focus is achieving initial client acquisition through Warm Outreach and leveraging personal connections.4

- Level 2 (Consistency): The business expands to consistent Free Content creation, applying the Rule of 100. The founder acts as the primary content and acquisition engine.4

- Level 3 (Process and Delegation): Staff are hired to execute More of what is already proven. The 3Ds model is critical for standardization. The introduction of Cold Outreach methods may begin at this stage.4

- Level 4 (Financial Stabilization): Attention pivots to improving the core product to maximize referrals (activating Lead Getter #1). Financial systems (LTGP tracking and CFA status) are stabilized, providing the necessary buffer for introducing riskier scaling methods, such as Running Paid Ads.4

- Level 5 (Productization and Management): At this stage (typically 10-19 employees), the focus expands to creating a second product to significantly increase LTGP.11 Marketing strategies diversify across multiple platforms, and professional operational and financial systems are established.11

- Level 6 (Specialization and Diversification): The organization hires specialized team members (e.g., dedicated Heads of Marketing and Content) to lead systematic efforts across all platforms, optimizing for Better conversion rates and constantly testing New channels and audiences.4

B. The Core Mindset: The Many Sided Die Parable

The “Many Sided Die” fable is presented as a philosophical conclusion to the systematic nature of scaling.5 The die represents the probabilistic outcome of any single lead generation attempt—whether a cold email, a piece of content, or a single ad campaign.

The central lesson is that success in scaling is not a single, lucky throw, but the guaranteed consequence of sustained action and process refinement. By maintaining a high volume of execution (rolling the die many times, aligning with the Rule of 100) and continuously refining the process (calibrating the die to favor favorable outcomes, reflecting the Better principle), success becomes a probabilistic certainty over time. This foundational philosophy reinforces the endurance mindset required for the multi-year scaling roadmap and validates the belief that “You cannot lose if you do not quit”.4

VII. Conclusion and Strategic Implementation Checklist

The $100M Leads framework provides a sophisticated, integrated playbook for scaling customer acquisition, demanding parallel excellence across three critical dimensions: Operational Consistency (The Core Four and Rule of 100), Financial Sustainability (LTGP:CAC and CFA status), and Systemic Leverage (3Ds and Lead Getters). Failure in any one dimension will bottleneck growth, regardless of performance in the others.

A. The One-Page Advertising Checklist

A key tactical framework within the system is the One-Page Advertising Checklist.9 The purpose of this checklist is to distill the complexity of the entire system into a simple, non-negotiable decision-making tool. Its function is to prevent management from scaling paid efforts (Running Paid Ads) on a flawed foundation. The checklist ensures all necessary prerequisites are met, including verification of the LTGP:CAC ratio, confirmation of CFA achievement, assessment of the Hook effectiveness metrics, and adherence to the daily volume mandated by the Rule of 100 targets.

B. Final Recommendations for the Scaling Executive

Based on the synthesis and analysis of this framework, three primary actionable recommendations are mandated for any scaling executive seeking repeatable, profitable growth:

- Prioritize Cash Flow Independence: Immediate executive focus must be directed toward achieving Client Financed Acquisition (CFA) status. This status must be engineered, using high-margin immediate upsells if necessary, to remove the capital ceiling that restricts the volume of paid acquisition efforts. Money should cease to be a limiting factor in lead flow.

- Institutionalize Competence through Process: The 3Ds model (Document, Demonstrate, Duplicate) must be adopted organization-wide to systematize the execution of the Core Four. This process operationalizes competence, ensuring that as the organization grows (Do More), the execution quality of critical tasks is maintained and measurable, preventing operational decline.

- Adhere to Strategic Patience and Sequencing: The sequencing of the Core Four (Warm Content Cold/Ads) is essential for risk mitigation. The executive must embrace the long-term compounding effects of audience building (Content) and the philosophical patience articulated in the Many Sided Die parable, recognizing that consistent, high-value content reduces future reliance on expensive cold traffic channels.

Source

More News

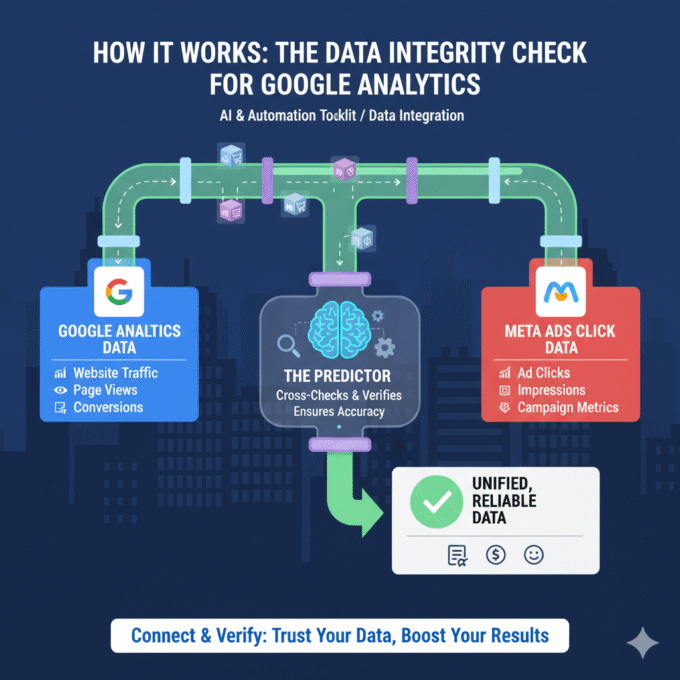

The Data Integrity Check for Google Analytics

How It Works: The Data Integrity Check for Google Analytics In the...

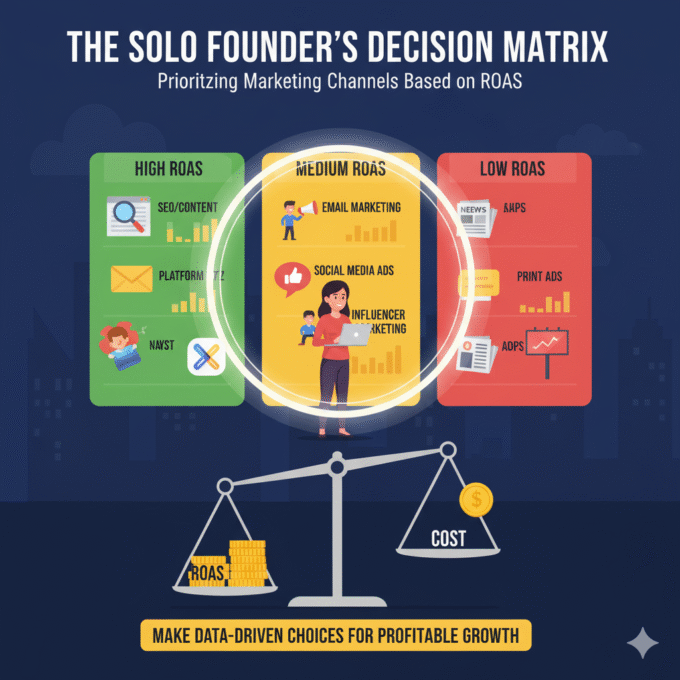

October 21, 2025The Solo Founder’s Decision Matrix: Prioritizing Marketing Channels Based on ROAS

The Solo Founder’s Decision Matrix As a solo founder, your most precious...

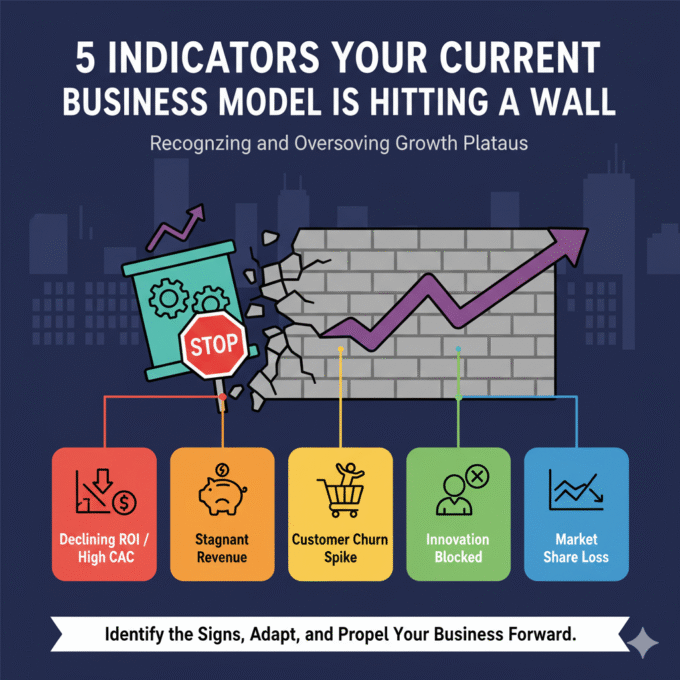

October 21, 20255 Indicators Your Current Business Model is Hitting a Wall

5 Indicators Your Current Business Model is Hitting a Wall The success...

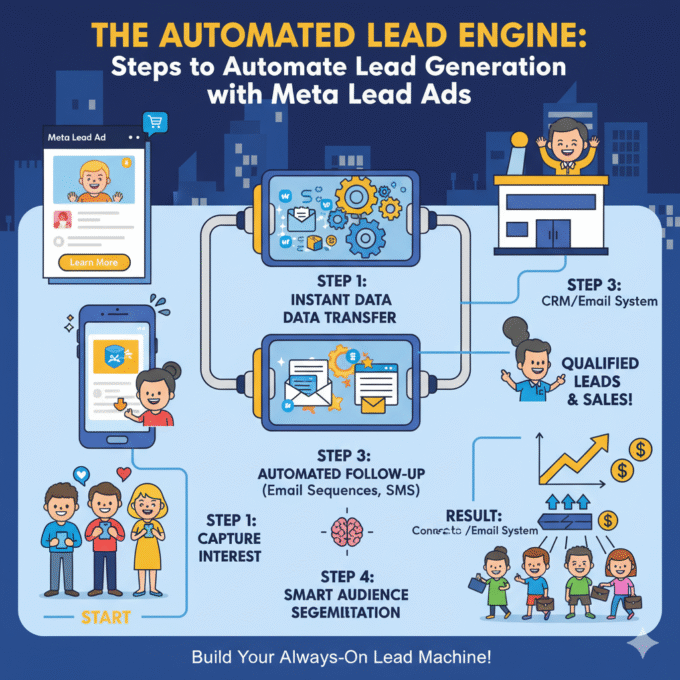

October 21, 2025The Automated Lead Engine: Steps to Automate Lead Generation with Meta Lead Ads

Steps to Automate Lead Generation with Meta Lead Ads Meta Lead Ads...

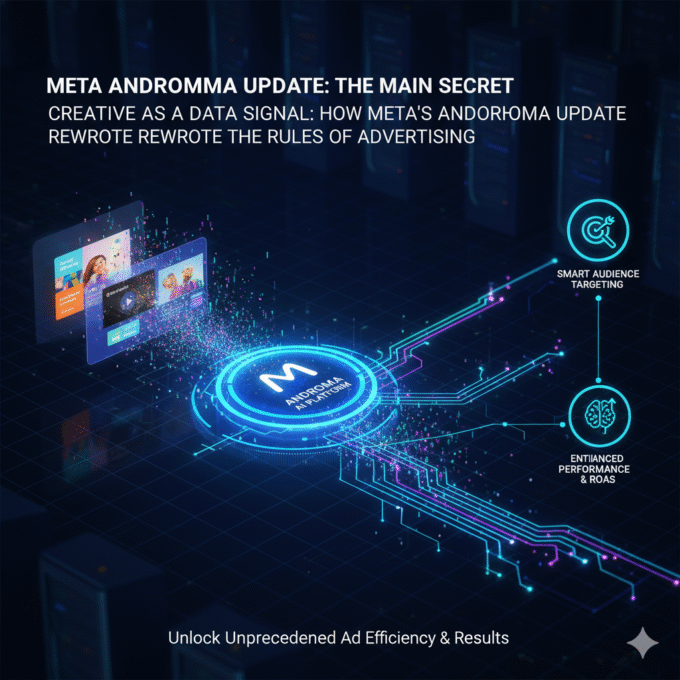

October 20, 2025META Andromeda update main secret

Creative as a Data Signal: How Meta’s Andromeda Update Rewrote the Rules...

October 20, 2025Meta Andromeda: The Next-Generation AI Engine for Performance Growth

I. Executive Summary: The Andromeda Paradigm Shift 1.1. Introduction to the AI...

October 14, 2025The Data Integrity Check for Google Analytics

How It Works: The Data Integrity Check for Google Analytics In the...

October 21, 2025The Solo Founder’s Decision Matrix: Prioritizing Marketing Channels Based on ROAS

The Solo Founder’s Decision Matrix As a solo founder, your most precious...

October 21, 20255 Indicators Your Current Business Model is Hitting a Wall

5 Indicators Your Current Business Model is Hitting a Wall The success...

October 21, 2025The Automated Lead Engine: Steps to Automate Lead Generation with Meta Lead Ads

Steps to Automate Lead Generation with Meta Lead Ads Meta Lead Ads...

October 20, 2025