The CLV:CAC Ratio Mastery Guide: Your Blueprint for Sustainable SaaS Growth

September 28, 20255 Mins read45 ViewsThe CLV:CAC Ratio Mastery Guide: Your Blueprint for Sustainable SaaS Growth

In the fast-paced world of SaaS, the siren song of rapid growth can be deafening. Companies pour millions into marketing campaigns, sales teams, and slick product launches, all in a race to acquire as many customers as possible. But what if you’re spending $100 to acquire a customer who only generates $50 in revenue? While your customer count may be rising, you’re on a fast track to financial disaster.

This is where the most critical metric for any SaaS business comes into play: the Customer Lifetime Value to Customer Acquisition Cost ratio, or CLV:CAC ratio.

More than just a number on a spreadsheet, this ratio is the true pulse of your business. It tells you whether your growth engine is a well-oiled machine or a leaky bucket. Mastering the CLV:CAC ratio is not just about understanding finance; it’s about creating a sustainable, profitable, and scalable business model. This guide will demystify this essential metric, provide the simple formulas to calculate it, and, most importantly, give you the actionable strategies to optimize it for long-term success.

What Exactly is the CLV:CAC Ratio?

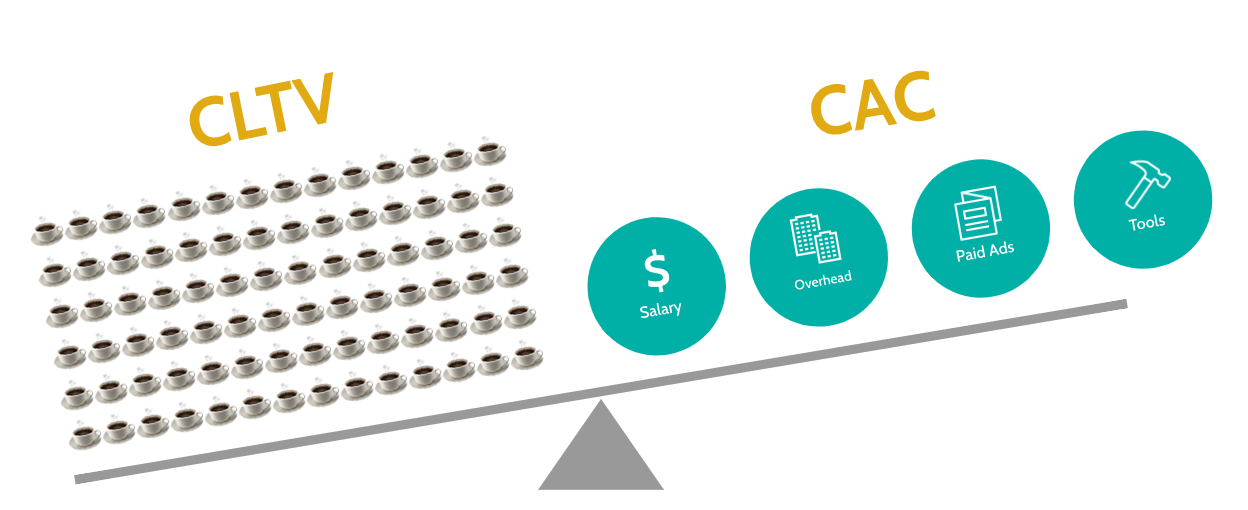

At its core, the CLV:CAC ratio is a measure of the relationship between the value a customer brings to your business over their entire relationship with you (Customer Lifetime Value) and the total cost incurred to acquire that customer in the first place (Customer Acquisition Cost).

In simple terms, it answers one fundamental question: “For every dollar we spend to acquire a customer, how many dollars do we get back in return?”

A high ratio indicates a healthy, profitable business model where your acquisition efforts are generating significant returns. A low ratio, however, is a clear warning sign that your business is not sustainable and needs immediate attention.

The Two Pillars: Deconstructing CLV and CAC

To master the ratio, you must first master its two components. While the concepts can seem complex, the formulas are surprisingly straightforward.

1. Mastering the Customer Lifetime Value (CLV) Calculation

Customer Lifetime Value, also known as LTV, is the total revenue you can reasonably expect from a single customer account throughout their entire business relationship with your company. It’s a powerful predictive metric that shifts your focus from short-term gains to long-term profitability.

The Simple CLV Formula:

For a straightforward understanding, a basic CLV formula for a subscription business is:

CLV=(AverageMonthlyRevenueperCustomer)/(MonthlyChurnRate)

Let’s break it down:

- Average Monthly Revenue per Customer (ARPU): This is the average revenue generated from each of your customers per month. To calculate this, take your total monthly recurring revenue (MRR) and divide it by your total number of customers.

- Monthly Churn Rate: This is the percentage of your customers who cancel their subscriptions each month. For example, if you start the month with 1,000 customers and lose 20, your churn rate is 2%.

Example Calculation:

- Your average customer pays you $50 per month.

- Your monthly churn rate is 2% (or 0.02).

CLV=$50/0.02=$2,500

This means, on average, a single customer is worth $2,500 to your business over their lifetime. This is a crucial number to know, as it sets the ceiling for how much you can afford to spend on acquisition.

2. Unpacking the Customer Acquisition Cost (CAC)

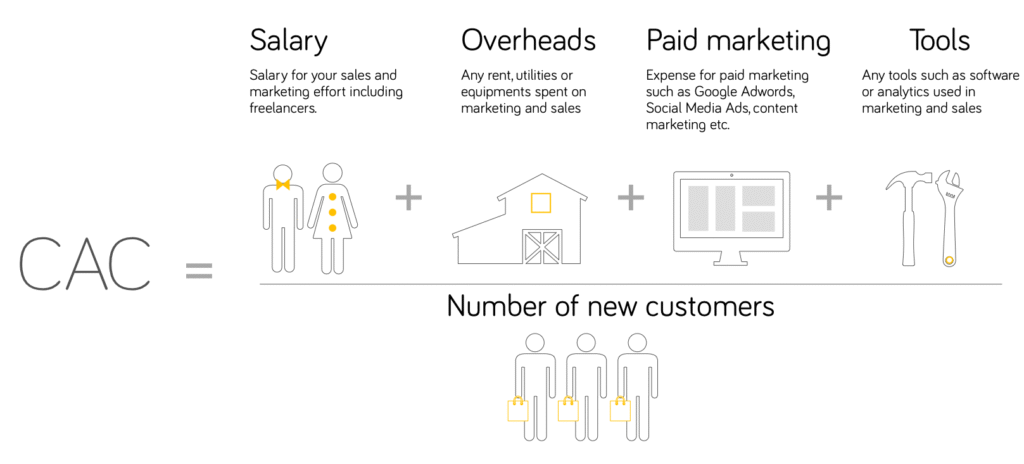

Customer Acquisition Cost represents the total expenditure on sales and marketing efforts required to acquire a new customer. This isn’t just your ad spend; it’s a comprehensive look at all the resources you dedicate to bringing a customer on board.

The Simple CAC Formula:

$CAC = (Total\, Sales\, &\, Marketing\, Costs) \, / \, (Number\, of\, New\, Customers\, Acquired)$

What to include in your costs:

- Salaries of your sales and marketing teams.

- Paid advertising expenses (Google Ads, Facebook Ads, etc.).

- Marketing automation and sales software subscriptions.

- Content creation costs (bloggers, designers, video editors).

- Any other overhead directly related to acquiring customers.

Example Calculation:

- Last quarter, you spent $50,000 on sales and marketing.

- In the same quarter, you acquired 250 new customers.

CAC=$50,000/250=$200

This means it cost you, on average, $200 to acquire a new customer.

The Golden Ratio: Benchmarks and What They Mean

Once you have your CLV and CAC figures, it’s time to put them together to calculate your CLV:CAC ratio. Using our examples from above:

CLV:CACRatio=$2,500:$200=12.5:1

Now, what does that number mean? Here are the industry benchmarks for SaaS and what each ratio tells you about the health of your business:

- CLV:CAC < 1:1: This is the “danger zone.” You are losing money on every single customer you acquire. Your business is not sustainable, and you need to immediately pivot your strategy to either increase your CLV or dramatically lower your CAC.

- CLV:CAC ≈ 1:1: You’re breaking even on customer acquisition. While you aren’t losing money, you aren’t generating profit to reinvest in growth. This is a fragile state where any increase in costs or churn could push you into the red.

- CLV:CAC = 3:1: The “gold standard.” This is the ideal ratio for a healthy, scalable SaaS business. For every dollar you spend on acquisition, you’re generating three dollars in lifetime value, giving you ample profit to fuel further growth, product development, and operational expenses.

- CLV:CAC > 4:1: While this might seem perfect, a ratio that is too high can sometimes indicate that you’re under-investing in sales and marketing. You might be missing out on opportunities for faster growth and could potentially acquire many more profitable customers if you loosened your purse strings.

Actionable Strategies to Optimize Your Ratio

Understanding your CLV:CAC ratio is only the first step. The real value lies in using this metric to make strategic decisions. You can optimize your ratio by tackling either side of the equation: increasing your CLV or decreasing your CAC.

To Increase Your Customer Lifetime Value (CLV):

- Focus on Customer Retention and Reduce Churn: This is the single most effective way to improve your CLV. A customer who stays with you for one more month adds significant value. Focus on improving your customer support, creating a robust and engaging onboarding process, and consistently communicating the value of your product.

- Upsell and Cross-Sell Strategically: Don’t just sell to new customers; sell more to your existing ones. Introduce higher-tier plans with premium features, offer add-on services, or bundle your products. A successful upselling strategy directly boosts your Average Revenue Per User (ARPU).

- Enhance Your Product and Service: A better product leads to happier customers who are less likely to leave. Continuously gather feedback, fix bugs, and release new features that delight your user base.

To Decrease Your Customer Acquisition Cost (CAC):

- Optimize Your Marketing Channels: Not all channels are created equal. Analyze your CAC by channel (e.g., paid ads, content marketing, organic search) and reallocate your budget to the most efficient ones. Investing more in channels with a lower CAC, like organic SEO and content marketing, can dramatically improve your ratio over time.

- Improve Conversion Rates: The less you have to spend to turn a lead into a customer, the lower your CAC will be. Focus on A/B testing your landing pages, refining your sales funnel, and writing more compelling calls to action. A small increase in your conversion rate can lead to a significant decrease in CAC.

- Implement a Referral Program: Word-of-mouth marketing is one of the most cost-effective ways to acquire new customers. Offer incentives (discounts, credits, or rewards) for existing customers to refer new ones.

- Streamline Your Sales Process: Reduce the time and resources it takes for your sales team to close a deal. Utilize a robust CRM, automate repetitive tasks, and provide your team with the tools they need to be more efficient.

The Ultimate Takeaway

The CLV:CAC ratio is not just another metric for your board meeting; it is a fundamental principle of sustainable business growth. It forces you to think holistically about your entire customer journey, from the first touchpoint to the moment of cancellation.

By regularly calculating and analyzing this ratio, you gain an unparalleled understanding of your business’s financial health. It empowers you to make smarter, data-driven decisions about where to invest your capital, how to optimize your marketing, and how to build a business that is not just growing, but growing profitably. Start calculating your ratio today, and take the first step toward building a truly sustainable SaaS success story.

More News

The Data Integrity Check for Google Analytics

How It Works: The Data Integrity Check for Google Analytics In the...

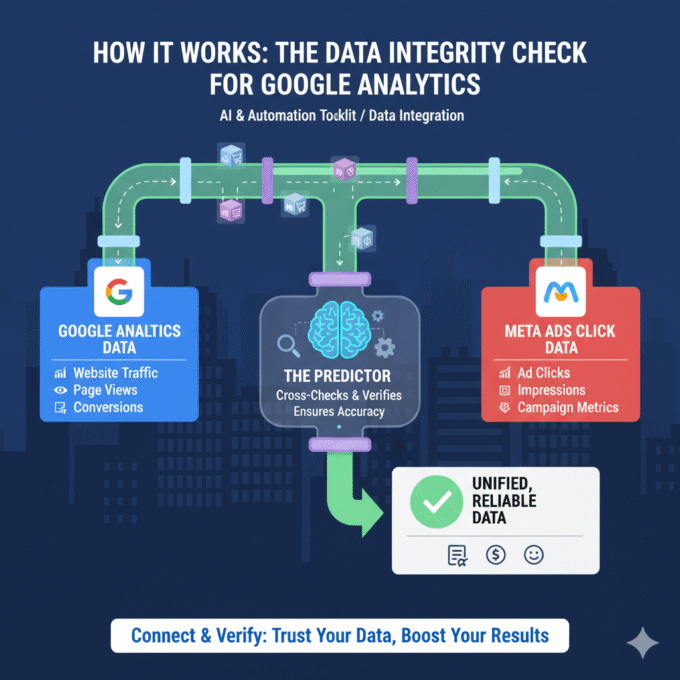

October 21, 2025The Solo Founder’s Decision Matrix: Prioritizing Marketing Channels Based on ROAS

The Solo Founder’s Decision Matrix As a solo founder, your most precious...

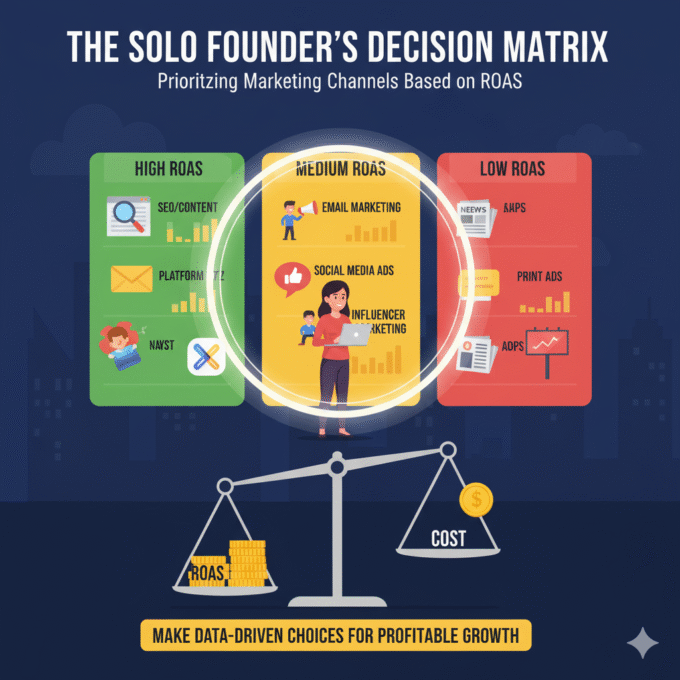

October 21, 20255 Indicators Your Current Business Model is Hitting a Wall

5 Indicators Your Current Business Model is Hitting a Wall The success...

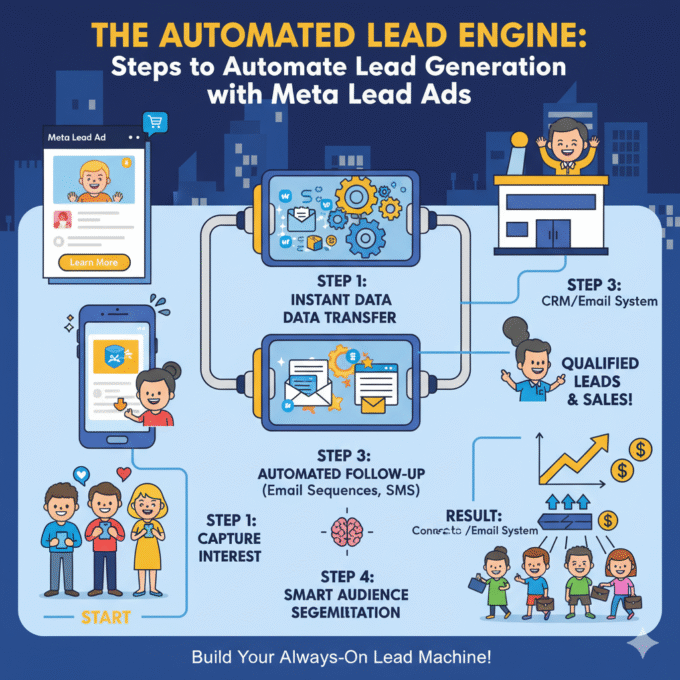

October 21, 2025The Automated Lead Engine: Steps to Automate Lead Generation with Meta Lead Ads

Steps to Automate Lead Generation with Meta Lead Ads Meta Lead Ads...

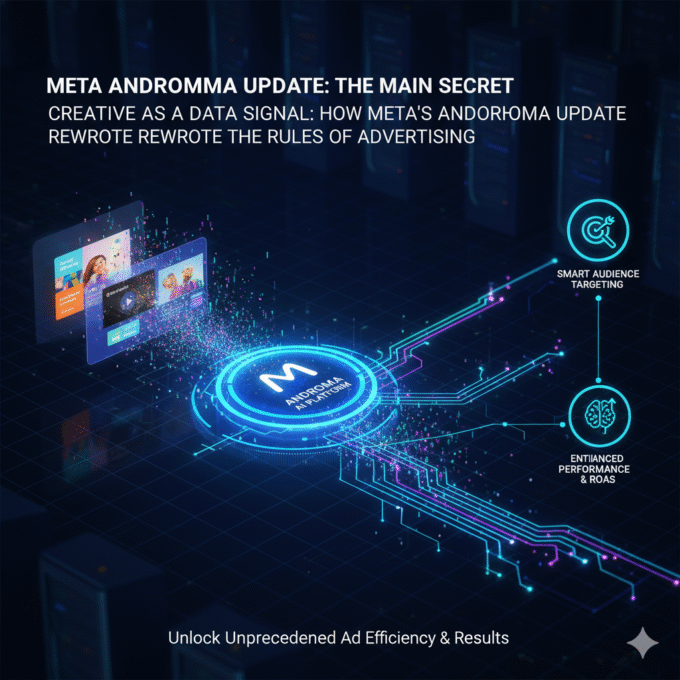

October 20, 2025META Andromeda update main secret

Creative as a Data Signal: How Meta’s Andromeda Update Rewrote the Rules...

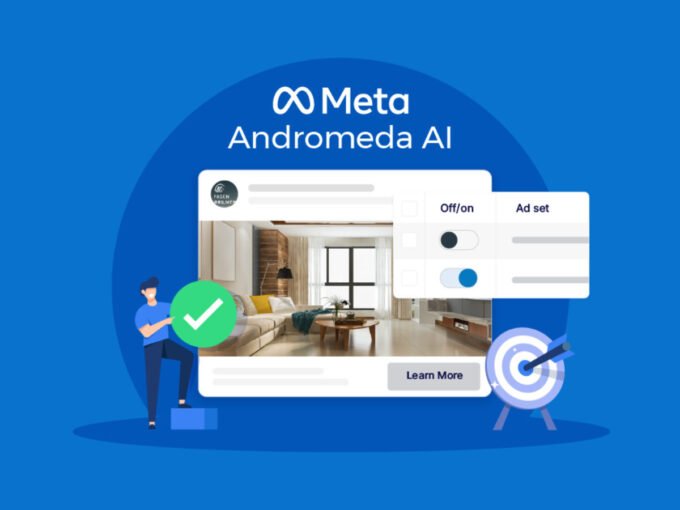

October 20, 2025Meta Andromeda: The Next-Generation AI Engine for Performance Growth

I. Executive Summary: The Andromeda Paradigm Shift 1.1. Introduction to the AI...

October 14, 2025The Data Integrity Check for Google Analytics

How It Works: The Data Integrity Check for Google Analytics In the...

October 21, 2025The Solo Founder’s Decision Matrix: Prioritizing Marketing Channels Based on ROAS

The Solo Founder’s Decision Matrix As a solo founder, your most precious...

October 21, 20255 Indicators Your Current Business Model is Hitting a Wall

5 Indicators Your Current Business Model is Hitting a Wall The success...

October 21, 2025The Automated Lead Engine: Steps to Automate Lead Generation with Meta Lead Ads

Steps to Automate Lead Generation with Meta Lead Ads Meta Lead Ads...

October 20, 2025