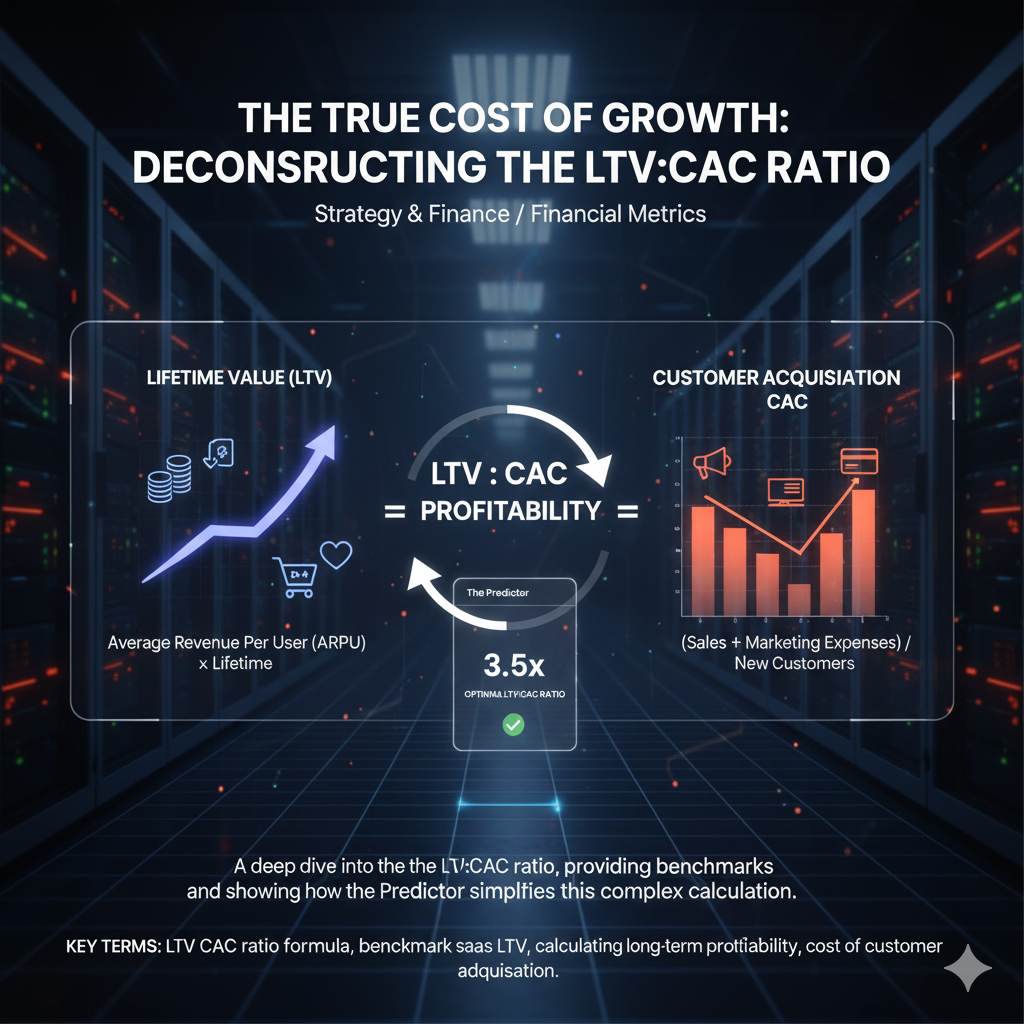

The True Cost of Growth: Deconstructing the LTV:CAC Ratio

September 29, 20254 Mins read42 ViewsThe True Cost of Growth: Deconstructing the LTV:CAC Ratio

Every business is built on a simple promise: revenue must exceed cost. But in the world of modern business, especially in SaaS and e-commerce, the simple profit and loss statement doesn’t tell the full story. You can be growing revenue at a phenomenal rate, yet still be on a fast track to financial collapse if you’re spending more to acquire a customer than they are worth to you over their lifetime.

This is where the LTV:CAC ratio becomes the single most important financial metric you can track.

More than just a number, this ratio is a direct reflection of your business’s sustainability and scalability. It answers the fundamental question: “For every dollar we spend to acquire a customer, how much are they worth to us in return?” This guide will provide a deep dive into this crucial ratio, offering the precise formulas, key industry benchmarks, and a clear path to simplifying its calculation.

What Exactly is LTV and Why It’s More Than Just Revenue

Customer Lifetime Value (LTV or CLV) is the total revenue a single customer is expected to bring to your business over the entire course of their relationship. It’s a forward-looking metric that forces you to think beyond the initial sale and consider the long-term profitability of each customer.

Focusing on LTV shifts your strategy from short-term customer acquisition to long-term customer retention. It’s the metric that tells you how much you can truly afford to spend on acquiring a new user.

For a subscription-based business, the LTV is calculated using a simple formula:

LTV Formula:

LTV=(AverageRevenuePerUser(ARPU))/(CustomerChurnRate)

Let’s break it down:

- Average Revenue Per User (ARPU): This is your average monthly or annual revenue per customer. You can calculate it by dividing your total revenue by your total number of customers for a given period.

- Customer Churn Rate: The percentage of customers who cancel their subscriptions in a given period.

Example Calculation:

- Your average customer pays you $100 per month.

- Your monthly customer churn rate is 2% (or 0.02).

LTV=$100/0.02=$5,000

This means that, on average, a single customer is worth $5,000 to your business over their lifetime.

Deconstructing the Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is the total cost of sales and marketing to acquire a new, paying customer. This number must be comprehensive—it includes far more than just your ad spend.

A true and accurate CAC calculation should include:

- Paid advertising spend (e.g., Meta, Google Ads)

- Salaries of your sales and marketing teams

- Commissions for your sales team

- Software subscriptions for marketing automation, CRM, and analytics

- Overhead costs related to marketing and sales (e.g., event sponsorships, content creation fees)

Once you’ve collected all these numbers, you can apply the cost of customer acquisition formula:

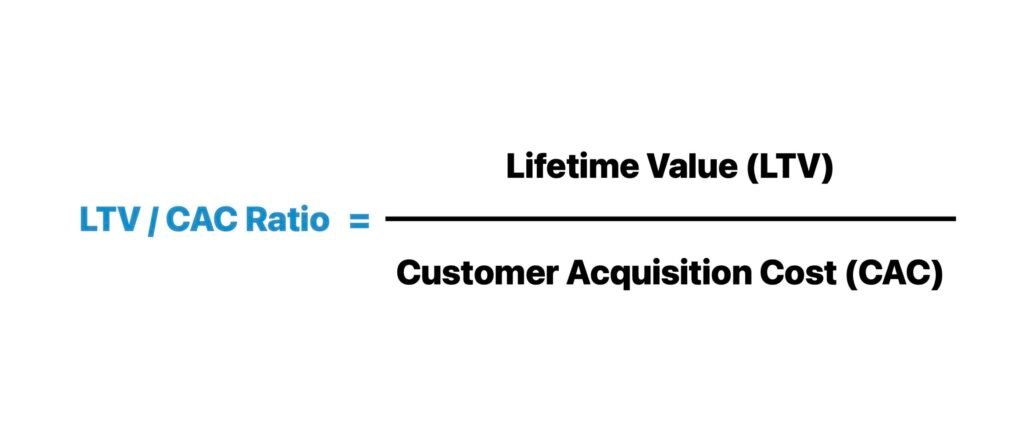

CAC Formula:

$CAC = (Total\, Sales\, &\, Marketing\, Costs) \, / \, (Number\, of\, New\, Customers\, Acquired)$

Example Calculation:

- You spent $100,000 last quarter on all sales and marketing activities.

- In the same quarter, you acquired 250 new customers.

CAC=$100,000/250=$400

It cost you, on average, $400 to acquire a new customer.

The Golden Ratio: LTV:CAC Benchmarks

Now that you have your LTV and CAC figures, you can finally calculate the ratio that determines the health of your business. Using our examples from above:

LTV:CACRatio=$5,000:$400=12.5:1

This is an exceptional ratio, but what do the common benchmarks mean?

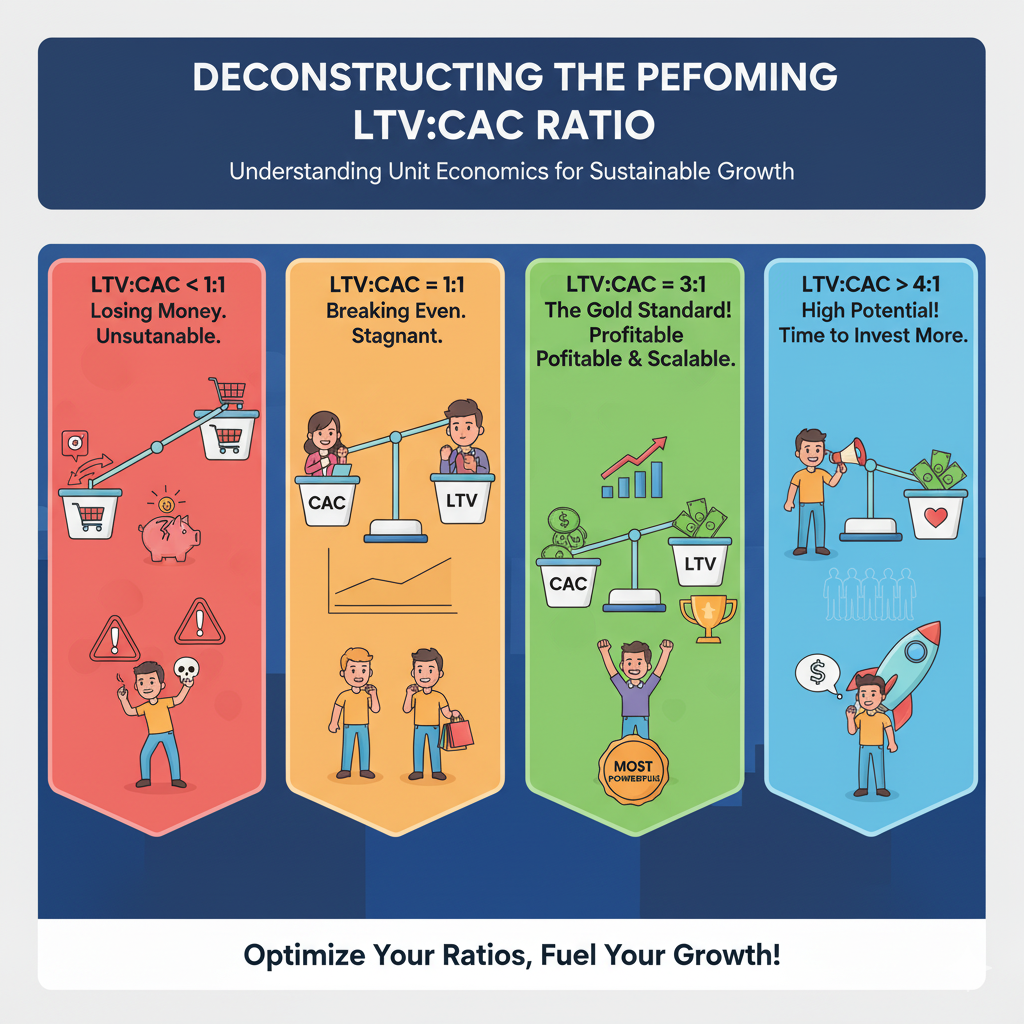

- LTV:CAC < 1:1: This is the danger zone. You are losing money on every customer you acquire. Your business is not sustainable, and you need to immediately address either your churn, your pricing, or your acquisition efficiency.

- LTV:CAC = 1:1: You are breaking even on customer acquisition. While not a loss, you are not generating enough profit to reinvest in growth. This model is stagnant and fragile.

- LTV:CAC = 3:1: The gold standard for any SaaS business. For every dollar you spend, you are getting three dollars back over the customer’s lifetime. This indicates a healthy business with a clear path to scalability and profit. This is the ideal benchmark saas LTV to aim for.

- LTV:CAC > 4:1: While this may seem perfect, a ratio this high can sometimes signal that you are under-investing in your marketing and sales. You may be missing out on opportunities for explosive growth by not spending enough to acquire more customers.

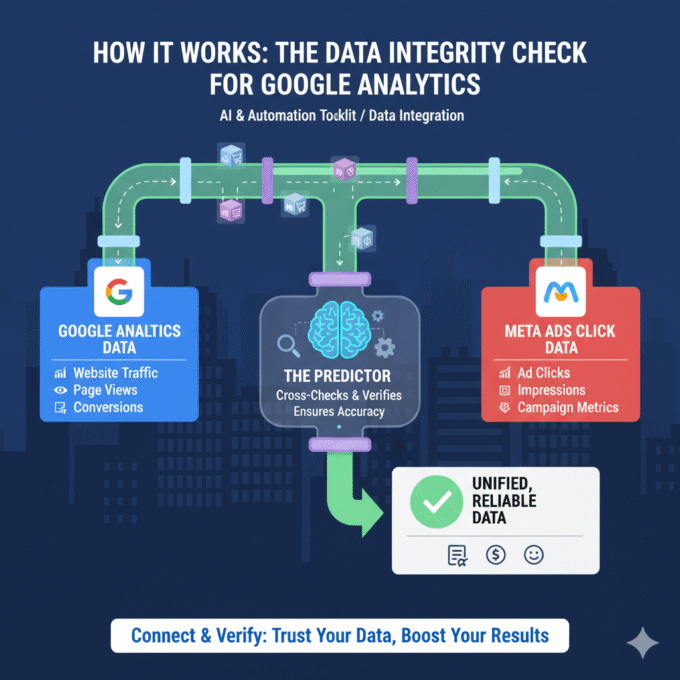

The Challenge of Manual Calculation and Siloed Data

Manually calculating long-term profitability using the LTV:CAC ratio is a monumental task. Your ad spend lives in Meta or Google Ads. Your revenue and customer data live in Shopify or Stripe. Your churn rate might be in a separate CRM.

This siloed approach means your data is never in one place. It requires manual, time-consuming exports and complex spreadsheets that are outdated the moment you finish them. This process is prone to error and makes it impossible to make real-time, data-driven decisions.

The Solution: How Predictor Simplifies the Calculation

This is where an automated, cross-platform data integration tool becomes indispensable.

A solution like Predictor is built to automatically connect all the disparate data sources in your business. It securely links your ad platforms (Meta, Google) to your revenue and subscription data (Shopify, Stripe). The result is a single, unified dashboard that automatically calculates and updates your LTV:CAC ratio in real time.

This means you can:

- See Your Ratio Instantly: Log in and see your LTV:CAC ratio for every single ad campaign. You can immediately identify which campaigns are generating highly profitable customers and which are costing you money.

- Drill Down to the Source: Analyze which specific ad sets or audiences are driving your most valuable customers. You can see a high LTV:CAC ratio for a specific ad set and then confidently double your budget.

- Make Proactive Decisions: Instead of waiting until the end of the quarter to see your numbers, you can make daily optimizations based on the most important metric in your business.

The LTV:CAC ratio formula is the key to understanding the true cost of your growth. By moving away from manual, siloed calculations and embracing a real-time, integrated system, you can stop guessing and start building a truly sustainable and profitable business.

More News

The Data Integrity Check for Google Analytics

How It Works: The Data Integrity Check for Google Analytics In the...

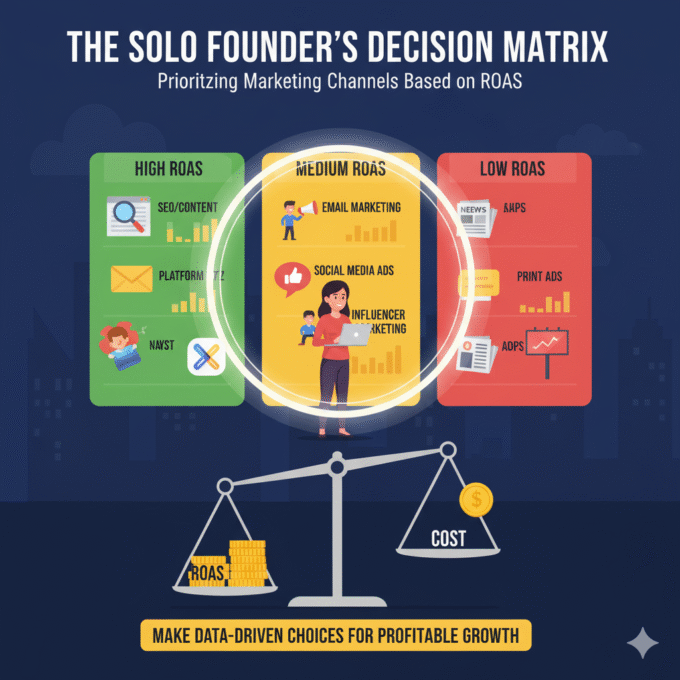

October 21, 2025The Solo Founder’s Decision Matrix: Prioritizing Marketing Channels Based on ROAS

The Solo Founder’s Decision Matrix As a solo founder, your most precious...

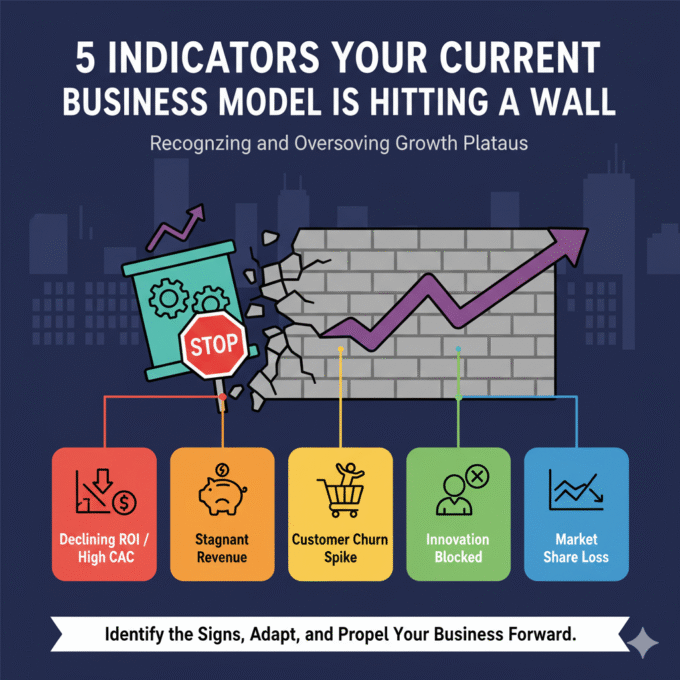

October 21, 20255 Indicators Your Current Business Model is Hitting a Wall

5 Indicators Your Current Business Model is Hitting a Wall The success...

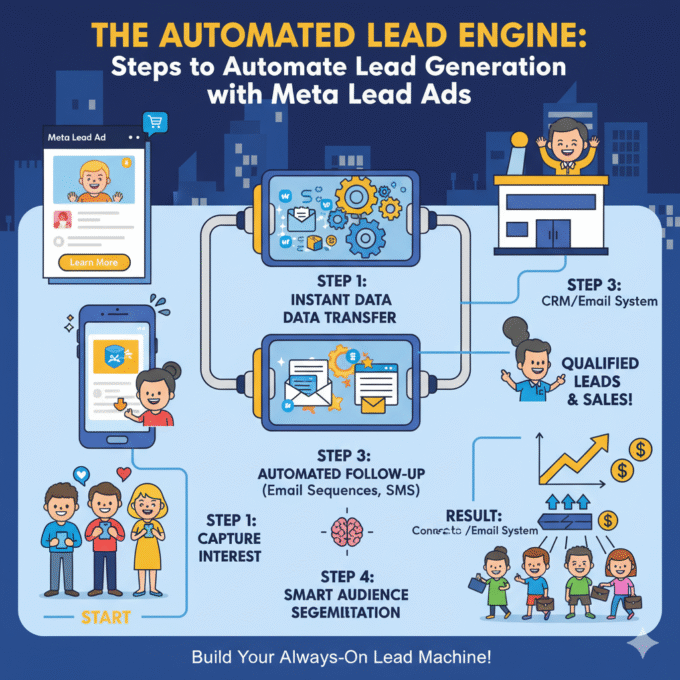

October 21, 2025The Automated Lead Engine: Steps to Automate Lead Generation with Meta Lead Ads

Steps to Automate Lead Generation with Meta Lead Ads Meta Lead Ads...

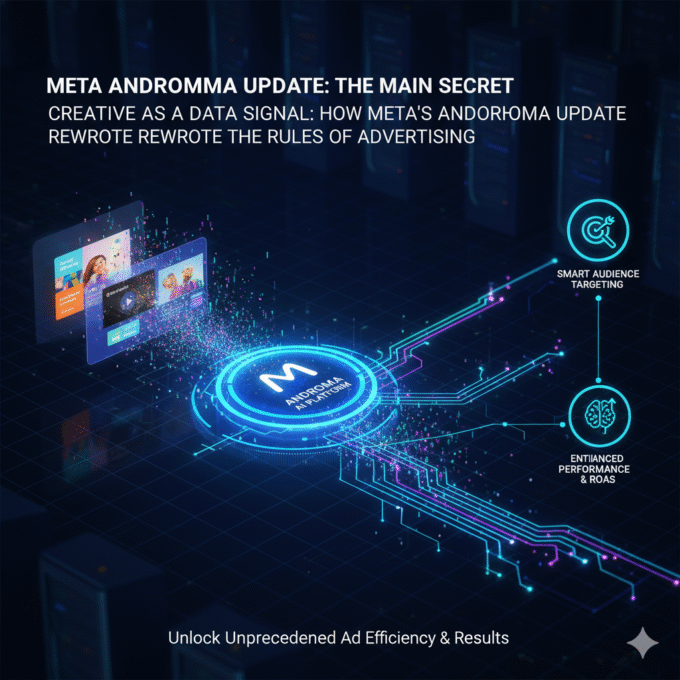

October 20, 2025META Andromeda update main secret

Creative as a Data Signal: How Meta’s Andromeda Update Rewrote the Rules...

October 20, 2025Meta Andromeda: The Next-Generation AI Engine for Performance Growth

I. Executive Summary: The Andromeda Paradigm Shift 1.1. Introduction to the AI...

October 14, 2025The Data Integrity Check for Google Analytics

How It Works: The Data Integrity Check for Google Analytics In the...

October 21, 2025The Solo Founder’s Decision Matrix: Prioritizing Marketing Channels Based on ROAS

The Solo Founder’s Decision Matrix As a solo founder, your most precious...

October 21, 20255 Indicators Your Current Business Model is Hitting a Wall

5 Indicators Your Current Business Model is Hitting a Wall The success...

October 21, 2025The Automated Lead Engine: Steps to Automate Lead Generation with Meta Lead Ads

Steps to Automate Lead Generation with Meta Lead Ads Meta Lead Ads...

October 20, 2025